Best Life Insurance for High-Net-Worth Individuals

Life insurance is an essential component of financial planning, especially for high-net-worth individuals (HNWIs). It provides financial security for loved ones, protects assets, and can be used for estate planning purposes. However, the life insurance needs of HNWIs are often more complex than those of individuals with more modest means. This article explores the best life insurance options for HNWIs, covering the different types of policies, key considerations, and strategies for maximizing the benefits of life insurance.

Understanding the Unique Needs of High-Net-Worth Individuals

HNWIs have distinct financial profiles and needs that require a tailored approach to life insurance. These needs often include:

-

Estate Planning: Life insurance can be used to cover estate taxes, ensuring that assets can be passed on to heirs without the burden of significant tax liabilities.

-

Wealth Transfer: Life insurance can facilitate the transfer of wealth to future generations, providing liquidity to cover expenses or fund specific goals.

-

Business Succession: For business owners, life insurance can fund buy-sell agreements, ensuring a smooth transition of ownership in the event of death or disability.

-

Charitable Giving: Life insurance can be used to make significant charitable donations, providing a lasting legacy and potential tax benefits.

-

Asset Protection: Life insurance can protect assets from creditors and lawsuits, providing a financial safety net in uncertain times.

Types of Life Insurance Policies for High-Net-Worth Individuals

Several types of life insurance policies are suitable for HNWIs, each with its own advantages and disadvantages:

-

Term Life Insurance: Term life insurance provides coverage for a specific period, typically 10 to 30 years. It is the most affordable type of life insurance, making it an attractive option for individuals who need a large amount of coverage for a specific period.

- Pros:

- Affordable premiums

- High coverage amounts

- Simple and straightforward

- Cons:

- Coverage expires at the end of the term

- Premiums increase upon renewal

- No cash value accumulation

- Pros:

-

Whole Life Insurance: Whole life insurance provides lifelong coverage and accumulates cash value over time. It offers a guaranteed death benefit and a fixed rate of return on the cash value.

- Pros:

- Lifelong coverage

- Guaranteed death benefit

- Cash value accumulation

- Tax-deferred growth

- Cons:

- Higher premiums than term life insurance

- Lower rate of return on cash value compared to other investment options

- Less flexibility than other types of life insurance

- Pros:

-

Universal Life Insurance: Universal life insurance offers flexible premiums and death benefits, allowing policyholders to adjust their coverage as their needs change. It also accumulates cash value, which grows tax-deferred.

- Pros:

- Flexible premiums and death benefits

- Cash value accumulation

- Tax-deferred growth

- Cons:

- Premiums can increase over time

- Cash value growth is not guaranteed

- More complex than term or whole life insurance

- Pros:

-

Variable Life Insurance: Variable life insurance allows policyholders to invest the cash value in a variety of investment options, such as stocks, bonds, and mutual funds. It offers the potential for higher returns but also carries more risk.

- Pros:

- Potential for higher returns

- Investment flexibility

- Tax-deferred growth

- Cons:

- Higher risk than other types of life insurance

- Premiums can fluctuate

- More complex than other types of life insurance

- Pros:

-

Indexed Universal Life Insurance: Indexed universal life insurance (IUL) is a type of permanent life insurance that combines the features of universal life insurance with the potential for cash value growth linked to a market index, such as the S&P 500.

- Pros:

- Potential for cash value growth linked to a market index

- Flexible premiums and death benefits

- Tax-deferred growth

- Cons:

- Cash value growth is capped

- Premiums can increase over time

- More complex than term or whole life insurance

- Pros:

Key Considerations for High-Net-Worth Individuals

When selecting life insurance, HNWIs should consider the following factors:

-

Coverage Amount: The amount of coverage should be sufficient to meet the individual’s financial needs, including estate taxes, wealth transfer goals, and business succession plans.

-

Policy Type: The type of policy should align with the individual’s risk tolerance, financial goals, and time horizon.

-

Premium Costs: The premiums should be affordable and sustainable over the long term.

-

Policy Features: The policy should offer the features and benefits that are most important to the individual, such as cash value accumulation, investment options, and flexibility.

-

Insurance Company: The insurance company should be financially stable and reputable, with a strong track record of paying claims.

Strategies for Maximizing the Benefits of Life Insurance

HNWIs can use several strategies to maximize the benefits of life insurance:

-

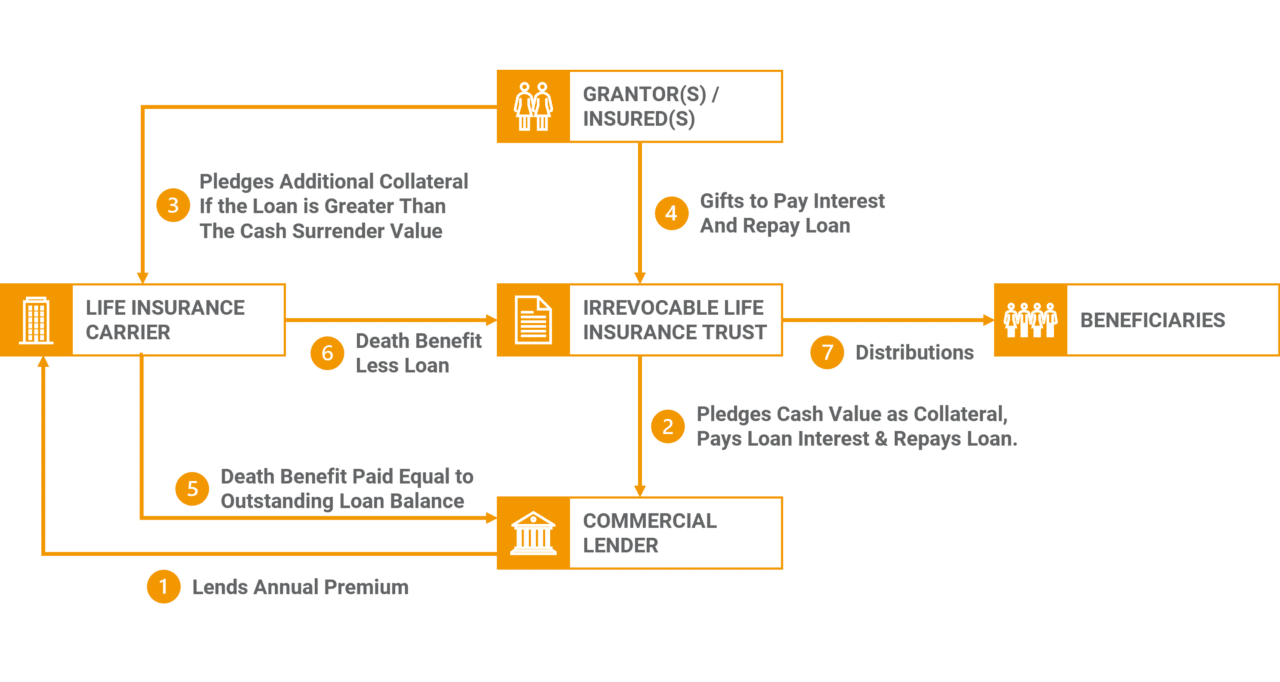

Irrevocable Life Insurance Trust (ILIT): An ILIT is a type of trust that owns and manages life insurance policies. It can help to minimize estate taxes and protect assets from creditors.

-

Premium Financing: Premium financing involves borrowing money to pay life insurance premiums. It can be a useful strategy for individuals who want to obtain a large amount of coverage without tying up their own capital.

-

Life Settlements: A life settlement involves selling a life insurance policy to a third party for a lump-sum payment. It can be a useful strategy for individuals who no longer need their life insurance coverage.

-

Charitable Giving: Life insurance can be used to make significant charitable donations, providing a lasting legacy and potential tax benefits.

-

Business Succession Planning: Life insurance can fund buy-sell agreements, ensuring a smooth transition of ownership in the event of death or disability.

Choosing the Right Life Insurance Advisor

Selecting the right life insurance advisor is crucial for HNWIs. An experienced advisor can help individuals assess their needs, evaluate different policy options, and develop a customized life insurance plan that meets their specific goals.

When choosing a life insurance advisor, look for the following qualities:

- Expertise: The advisor should have a deep understanding of life insurance products and strategies.

- Experience: The advisor should have experience working with HNWIs and their unique needs.

- Independence: The advisor should be independent and unbiased, representing the client’s best interests.

- Communication: The advisor should be able to communicate clearly and effectively, explaining complex concepts in a way that is easy to understand.

- Trustworthiness: The advisor should be trustworthy and ethical, with a commitment to putting the client’s needs first.

Conclusion

Life insurance is an essential component of financial planning for HNWIs. By understanding the different types of policies, key considerations, and strategies for maximizing the benefits of life insurance, HNWIs can protect their assets, provide financial security for their loved ones, and achieve their long-term financial goals. Working with an experienced and trusted life insurance advisor is crucial for developing a customized plan that meets their specific needs.