Best Budget-Friendly Life Insurance Policies for 2025

Life insurance is a crucial financial tool that provides a safety net for your loved ones in the event of your untimely demise. It can help cover expenses like funeral costs, mortgage payments, education expenses, and everyday living expenses, ensuring that your family is financially secure when you’re no longer there to support them.

However, many people put off purchasing life insurance because they believe it’s too expensive. While some life insurance policies can be costly, there are also many budget-friendly options available that can provide adequate coverage without breaking the bank.

In this article, we’ll explore some of the best budget-friendly life insurance policies for 2025, helping you find a policy that fits your needs and your budget.

Types of Budget-Friendly Life Insurance Policies

When it comes to budget-friendly life insurance, there are two main types to consider: term life insurance and whole life insurance.

-

Term Life Insurance: Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. If you pass away during the term, your beneficiaries will receive a death benefit. If you outlive the term, the coverage expires, and you’ll need to renew the policy or purchase a new one.

Term life insurance is generally the most affordable type of life insurance because it only provides coverage for a limited time. It’s a good option for people who need coverage for a specific period, such as while they’re raising children or paying off a mortgage.

-

Whole Life Insurance: Whole life insurance provides coverage for your entire life, as long as you continue to pay the premiums. It also includes a cash value component that grows over time on a tax-deferred basis. You can borrow against the cash value or withdraw it, but doing so will reduce the death benefit.

Whole life insurance is more expensive than term life insurance because it provides lifelong coverage and includes a cash value component. However, it can be a good option for people who want lifelong coverage and the potential for cash value growth.

Factors Affecting Life Insurance Premiums

Several factors can affect the cost of life insurance premiums, including:

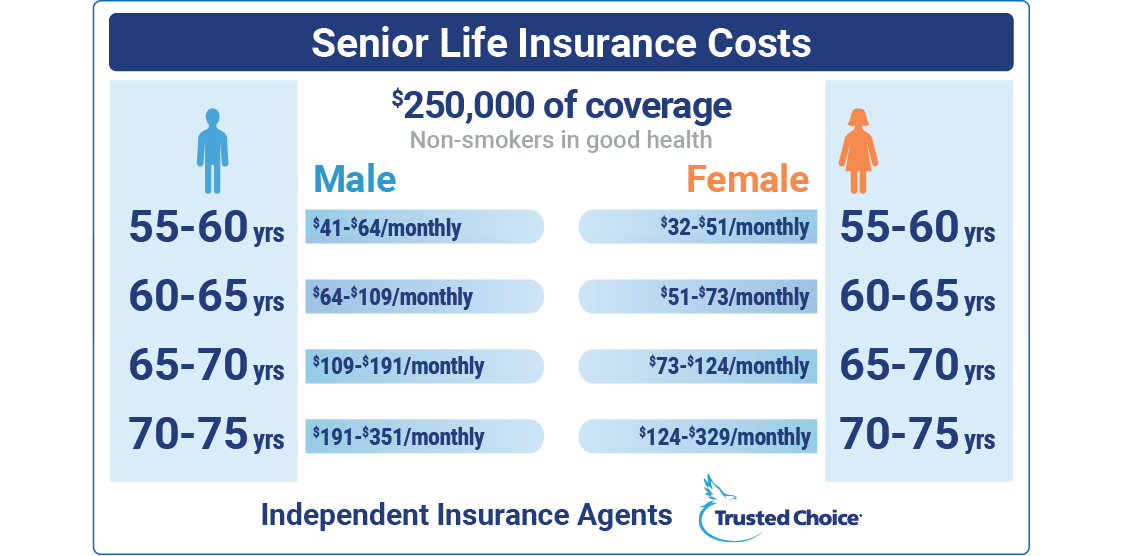

- Age: The older you are, the higher your premiums will be. This is because older people are statistically more likely to die than younger people.

- Health: If you have any health problems, your premiums will be higher. This is because people with health problems are statistically more likely to die than healthy people.

- Lifestyle: Certain lifestyle factors, such as smoking or engaging in risky activities, can also increase your premiums.

- Coverage Amount: The more coverage you need, the higher your premiums will be.

- Policy Type: As mentioned earlier, term life insurance is generally less expensive than whole life insurance.

- Policy Length: The longer the term of a term life insurance policy, the higher the premiums will be.

Best Budget-Friendly Life Insurance Policies for 2025

Here are some of the best budget-friendly life insurance policies to consider in 2025:

- Ladder Life: Ladder Life offers term life insurance policies with flexible coverage amounts and terms. You can apply online in minutes and adjust your coverage as your needs change. Ladder Life is a good option for people who want a simple, affordable term life insurance policy.

- Fabric: Fabric is another online life insurance company that offers term life insurance policies. Fabric also offers a free will-making tool and other financial planning resources. Fabric is a good option for young families who want affordable life insurance and other financial planning tools.

- Haven Life: Haven Life offers term life insurance policies underwritten by MassMutual. You can apply online and get an instant decision. Haven Life is a good option for people who want a quick and easy way to get term life insurance.

- Bestow: Bestow offers term life insurance policies with no medical exam required. You can apply online and get a decision in minutes. Bestow is a good option for people who want to avoid a medical exam or who have health conditions that might make it difficult to get traditional life insurance.

- State Farm: State Farm is a well-known insurance company that offers both term and whole life insurance policies. State Farm has a wide range of coverage options and can help you find a policy that fits your needs and budget.

- Transamerica: Transamerica is another large insurance company that offers both term and whole life insurance policies. Transamerica also offers a variety of riders that can customize your policy to meet your specific needs.

- Nationwide: Nationwide offers both term and whole life insurance policies, as well as universal life insurance policies. Nationwide is a good option for people who want a variety of life insurance options to choose from.

- Protective: Protective offers term and whole life insurance policies with competitive rates. Protective is a good option for people who want to compare rates from multiple insurers.

Tips for Finding the Best Budget-Friendly Life Insurance Policy

Here are some tips for finding the best budget-friendly life insurance policy:

- Determine how much coverage you need: The first step is to determine how much coverage you need. Consider your debts, income, and financial obligations to your loved ones. A good rule of thumb is to purchase coverage that is 10-12 times your annual income.

- Shop around and compare rates: Don’t just settle for the first policy you find. Shop around and compare rates from multiple insurers to find the best deal.

- Consider term life insurance: Term life insurance is generally the most affordable type of life insurance. If you only need coverage for a specific period, term life insurance is a good option.

- Consider a shorter term: The shorter the term of a term life insurance policy, the lower the premiums will be. If you don’t need coverage for a long period, consider a shorter term.

- Improve your health: If you’re not in good health, take steps to improve your health. This could include quitting smoking, losing weight, and managing any health conditions you have. Improving your health can lower your life insurance premiums.

- Pay annually: Some insurers offer a discount if you pay your premiums annually instead of monthly.

- Work with an independent insurance agent: An independent insurance agent can help you compare rates from multiple insurers and find a policy that fits your needs and budget.

Conclusion

Life insurance is an important financial tool that can provide peace of mind knowing that your loved ones will be taken care of financially in the event of your death. While some life insurance policies can be expensive, there are also many budget-friendly options available. By considering term life insurance, shopping around for rates, and improving your health, you can find a life insurance policy that fits your needs and your budget.

Disclaimer: I am an AI chatbot and cannot provide financial advice. This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any financial decisions.