Must-Have Life Insurance Riders for Extra Protection

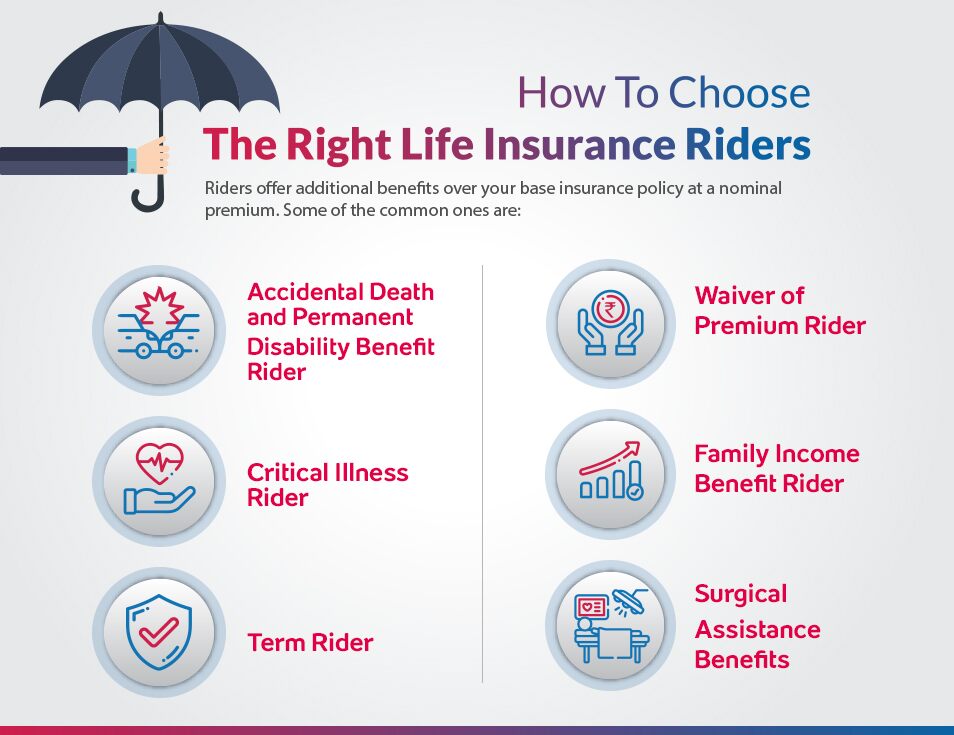

Life insurance is a cornerstone of financial planning, offering a safety net for your loved ones in the event of your passing. While the base policy provides a death benefit, riders can significantly enhance its value, tailoring the coverage to your specific needs and circumstances. These riders are essentially add-ons that provide extra protection and benefits beyond the standard policy.

Choosing the right riders can transform a basic life insurance policy into a comprehensive financial tool. However, it’s crucial to understand what riders are available, how they work, and whether they align with your individual situation.

What are Life Insurance Riders?

Life insurance riders are supplementary provisions that you can add to your base life insurance policy. They provide extra benefits or modify the terms of the original policy to better suit your needs. These riders often come at an additional cost, but they can provide valuable protection and peace of mind.

Why Consider Life Insurance Riders?

- Customization: Riders allow you to tailor your policy to your unique needs and circumstances, ensuring comprehensive coverage.

- Enhanced Protection: They provide additional layers of protection beyond the standard death benefit, covering specific risks or events.

- Flexibility: Riders can be added or removed as your needs change, offering flexibility in your insurance coverage.

- Cost-Effectiveness: In some cases, adding a rider can be more cost-effective than purchasing a separate insurance policy for the same coverage.

Essential Life Insurance Riders to Consider

Here are some of the most valuable life insurance riders that you should consider adding to your policy:

-

Accidental Death Benefit Rider (ADBR)

- What it is: This rider provides an additional death benefit if the insured dies as a result of an accident. The payout is typically a multiple (e.g., double or triple) of the base policy’s death benefit.

- Why it’s important: Accidents can happen to anyone, and the ADBR provides extra financial support to your beneficiaries in such unfortunate circumstances.

- Who should consider it: Individuals who engage in high-risk activities (e.g., extreme sports, frequent travel) or have jobs with higher accident rates.

-

Waiver of Premium Rider

- What it is: If the insured becomes totally disabled and unable to work due to illness or injury, this rider waives the premium payments for a specified period (usually until recovery or the end of the policy term).

- Why it’s important: Disability can lead to financial hardship, and this rider ensures that your life insurance coverage remains in force even if you can’t afford to pay the premiums.

- Who should consider it: Anyone who relies on their income to pay for life insurance premiums, especially those in physically demanding jobs or with pre-existing health conditions.

-

Accelerated Death Benefit Rider (ADBR) / Living Benefits Rider

- What it is: This rider allows you to access a portion of your death benefit while you’re still alive if you’re diagnosed with a terminal illness or a qualifying chronic condition.

- Why it’s important: Provides funds to cover medical expenses, long-term care costs, or other financial needs during a critical illness.

- Who should consider it: Individuals concerned about the financial burden of a serious illness, especially those with a family history of such conditions.

-

Critical Illness Rider

- What it is: This rider pays out a lump sum if you’re diagnosed with a covered critical illness, such as cancer, heart attack, stroke, or kidney failure.

- Why it’s important: Critical illnesses can be expensive to treat, and this rider provides funds to cover medical bills, living expenses, or other financial needs.

- Who should consider it: Individuals with a family history of critical illnesses or those concerned about the financial impact of a serious health condition.

-

Long-Term Care Rider

- What it is: This rider allows you to use a portion of your death benefit to pay for long-term care services, such as nursing home care, assisted living, or home healthcare.

- Why it’s important: Long-term care can be incredibly expensive, and this rider provides funds to cover these costs without depleting your other assets.

- Who should consider it: Individuals concerned about the potential need for long-term care in the future, especially those with a family history of dementia or other age-related conditions.

-

Children’s Term Rider

- What it is: This rider provides life insurance coverage for your children. If a child passes away, the rider pays out a death benefit.

- Why it’s important: While no amount of money can replace a child, this rider can help cover funeral expenses and provide financial support during a difficult time. It also allows you to convert the rider to a permanent policy for your child when they reach adulthood, guaranteeing future insurability.

- Who should consider it: Parents who want to provide financial protection for their children and ensure their future insurability.

-

Guaranteed Insurability Rider (GIR)

- What it is: This rider allows you to purchase additional life insurance coverage at specified intervals (e.g., every three years) without having to undergo a medical exam.

- Why it’s important: Your insurance needs may increase over time due to marriage, children, or increased financial obligations. This rider guarantees that you can obtain additional coverage even if your health declines.

- Who should consider it: Young adults who anticipate needing more life insurance coverage in the future, especially those with a family history of health issues.

-

Return of Premium Rider (ROP)

- What it is: This rider returns the premiums you paid over the policy term if you outlive the policy.

- Why it’s important: Provides a return on your investment if you don’t die during the policy term. It essentially makes the life insurance policy a form of savings.

- Who should consider it: Individuals who want life insurance protection but also want to recoup their premiums if they don’t need the death benefit.

-

Spousal Rider

- What it is: Provides a term life insurance coverage for your spouse under your primary life insurance policy.

- Why it’s important: A cost-effective way to provide financial protection for your spouse without the need for a separate policy.

- Who should consider it: Married individuals who want to ensure both partners are covered without the hassle of managing multiple policies.

Factors to Consider When Choosing Riders

- Your Needs: Evaluate your individual circumstances, family situation, and financial goals to determine which riders are most relevant to you.

- Cost: Riders come at an additional cost, so consider your budget and whether the benefits outweigh the expenses.

- Policy Terms: Understand the terms and conditions of each rider, including any limitations or exclusions.

- Insurance Company: Choose an insurance company with a good reputation and a wide range of rider options.

How to Choose the Right Riders

- Assess Your Needs: Determine your financial goals, family situation, and potential risks.

- Research Rider Options: Explore the different types of riders available and their benefits.

- Compare Costs: Obtain quotes from multiple insurance companies and compare the costs of different riders.

- Consult with a Financial Advisor: Seek professional advice from a financial advisor to help you choose the right riders for your specific needs.

- Review Your Policy Regularly: As your life changes, review your life insurance policy and make adjustments to your riders as needed.

Conclusion

Life insurance riders can significantly enhance the value and protection of your life insurance policy. By carefully considering your needs and choosing the right riders, you can create a comprehensive financial plan that protects your loved ones and provides peace of mind. Remember to consult with a financial advisor to determine which riders are best suited for your individual situation.

Disclaimer: I am an AI Chatbot and not a financial advisor. This information is for general knowledge and educational purposes only, and does not constitute financial advice. Always consult with a qualified financial advisor before making any decisions about life insurance or other financial products.