Critical Illness Rider vs. Accelerated Death Benefit Rider: Understanding the Nuances for Informed Insurance Decisions

In the realm of life insurance, riders serve as valuable add-ons that tailor coverage to individual needs and circumstances. Among the most significant are Critical Illness Riders and Accelerated Death Benefit Riders. Both offer financial protection in the face of serious health challenges, but they operate differently. This article provides a detailed comparison to help you make an informed decision about which rider, or combination of riders, best suits your unique situation.

What is a Critical Illness Rider?

A Critical Illness Rider is an optional add-on to a life insurance policy that provides a lump-sum payment if the insured is diagnosed with a covered critical illness. Common covered illnesses include:

- Heart Attack: A severe heart attack meeting specific diagnostic criteria.

- Stroke: A cerebrovascular event resulting in neurological deficits.

- Cancer: Often covers a range of invasive cancers.

- Kidney Failure: End-stage renal disease requiring dialysis or transplant.

- Organ Transplant: The need for a major organ transplant.

- Multiple Sclerosis: A confirmed diagnosis of this autoimmune disease.

- Alzheimer’s Disease: Severe cognitive impairment.

- Parkinson’s Disease: A progressive neurological disorder.

- Blindness: Irreversible loss of vision.

- Paralysis: Loss of movement in limbs.

How it Works:

- Diagnosis: If the insured is diagnosed with a covered critical illness that meets the policy’s definition, they can file a claim.

- Claim Approval: Upon approval, the insurance company pays a lump-sum benefit.

- Benefit Usage: The insured can use the benefit as they see fit, such as for medical expenses, lifestyle adjustments, or debt repayment.

- Policy Continuation: The life insurance policy typically remains in force, with the death benefit unchanged, unless the rider stipulates otherwise.

Key Features of Critical Illness Riders:

- Lump-Sum Payment: Provides immediate access to a substantial sum of money.

- Specific Illnesses: Coverage is limited to a predefined list of critical illnesses.

- Unrestricted Use: The benefit can be used for any purpose, without limitations.

- Policy Continuation: The base life insurance policy remains active.

- Waiting Period: There may be a waiting period after the policy is issued before the rider becomes effective.

- Survival Period: Some riders require the insured to survive a certain period (e.g., 30 days) after diagnosis to receive the benefit.

- Cost: Adds to the overall premium of the life insurance policy.

What is an Accelerated Death Benefit Rider?

An Accelerated Death Benefit (ADB) Rider, also known as a Living Benefit Rider, allows the insured to access a portion of their life insurance policy’s death benefit while still alive if they experience a qualifying event. Common qualifying events include:

- Terminal Illness: A medical condition with a life expectancy of 24 months or less (this timeframe can vary by policy).

- Chronic Illness: A condition that prevents the insured from performing at least two Activities of Daily Living (ADLs) without substantial assistance, or severe cognitive impairment.

- Critical Illness: Some ADB riders may also cover critical illnesses, similar to a Critical Illness Rider.

- Long-Term Care: The need for extended care in a nursing home or at home.

How it Works:

- Qualifying Event: The insured experiences a qualifying event as defined by the policy.

- Claim Filing: The insured files a claim with the insurance company.

- Benefit Acceleration: If approved, the insurance company accelerates a portion of the death benefit, paying it to the insured.

- Reduced Death Benefit: The death benefit paid to beneficiaries upon the insured’s death is reduced by the amount accelerated, plus any applicable fees.

- Policy Termination: In some cases, accelerating a large portion of the death benefit may terminate the policy.

Key Features of Accelerated Death Benefit Riders:

- Access to Death Benefit: Provides access to the policy’s death benefit during the insured’s lifetime.

- Qualifying Events: Coverage is triggered by specific events, such as terminal illness or chronic illness.

- Reduced Death Benefit: The death benefit paid to beneficiaries is reduced by the amount accelerated.

- Flexible Use: The accelerated benefit can be used for any purpose.

- Cost: Often included in the base life insurance policy at no additional cost (but may have an impact on the policy’s cash value or internal costs).

- Limitations: There may be limits on the amount that can be accelerated.

- Tax Implications: The accelerated benefit may have tax implications, depending on the circumstances.

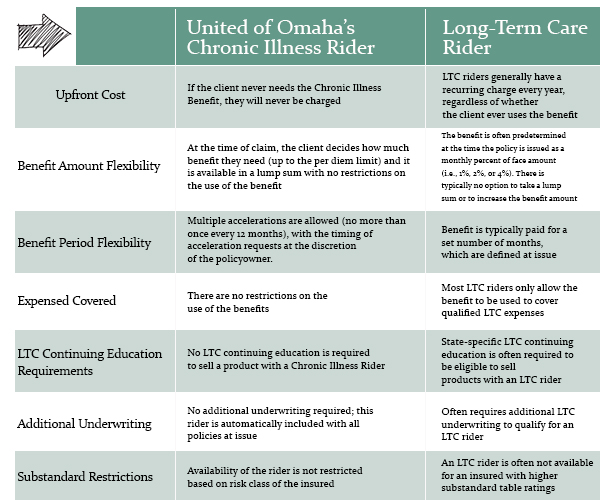

Critical Illness Rider vs. Accelerated Death Benefit Rider: A Detailed Comparison

| Feature | Critical Illness Rider | Accelerated Death Benefit Rider |

|---|