What You Should Know About Burial and Final Expense Insurance

Death is an inevitable part of life, but it is often a topic that people shy away from discussing. However, planning for the inevitable is a responsible and caring thing to do for your loved ones. One crucial aspect of this planning is considering how your final expenses will be covered. This is where burial and final expense insurance come into play. In this comprehensive guide, we will delve into what burial and final expense insurance are, how they work, their benefits, and everything else you need to know to make an informed decision.

What is Burial Insurance?

Burial insurance, also known as final expense insurance, is a type of life insurance policy designed to cover the costs associated with a person’s death. These costs can include funeral expenses, burial costs, cremation expenses, and other end-of-life expenses. The primary purpose of burial insurance is to provide your family with the financial resources they need to handle these expenses without having to dip into their savings or take on debt.

How Does Burial Insurance Work?

Burial insurance is typically a whole life insurance policy, which means it offers lifelong coverage as long as the premiums are paid. Here’s how it generally works:

-

Application: You apply for a burial insurance policy, providing information about your age, health, and desired coverage amount.

Underwriting: The insurance company reviews your application and may require a medical exam or ask health-related questions to assess your risk. However, many burial insurance policies are simplified issue or guaranteed acceptance, which means they have minimal or no health requirements.

-

Premium Payments: If your application is approved, you’ll need to make regular premium payments. The premium amount is typically fixed and will depend on factors such as your age, health, and the coverage amount you choose.

-

Coverage: Once the policy is in place, it provides coverage for your entire life, as long as you continue to pay the premiums.

-

Death Benefit: When you pass away, your beneficiaries will receive a lump-sum payment, known as the death benefit. This money can be used to cover funeral expenses, burial costs, or any other final expenses.

Types of Burial Insurance Policies

Burial insurance policies come in various forms to cater to different needs and preferences. Here are some common types:

-

Simplified Issue Burial Insurance: These policies typically have minimal health questions and no medical exam. They are a good option for individuals with pre-existing health conditions.

-

Guaranteed Acceptance Burial Insurance: As the name suggests, these policies guarantee acceptance, regardless of your health. However, they may have a waiting period before the full death benefit is available.

-

Level Benefit Burial Insurance: These policies offer a level death benefit, meaning the payout remains the same throughout the policy’s duration.

-

Graded Benefit Burial Insurance: Graded benefit policies may have a waiting period, during which the death benefit is limited. The full death benefit becomes available after the waiting period has passed.

What Does Burial Insurance Cover?

Burial insurance is designed to cover a range of final expenses. Here are some common costs that can be covered by a burial insurance policy:

- Funeral Expenses: This includes the cost of the funeral service, embalming, cremation, casket, and other related expenses.

- Burial Costs: If you choose burial, the policy can cover the cost of a burial plot, grave marker, and interment fees.

- Cremation Expenses: For those who prefer cremation, the policy can cover cremation fees, urn costs, and memorial services.

- Medical Bills: Unpaid medical bills can be a significant burden for your family. Burial insurance can help cover these expenses.

- Legal and Administrative Fees: There may be legal and administrative costs associated with settling your estate.

- Outstanding Debts: While burial insurance is not specifically designed to pay off debts, the death benefit can be used for this purpose if your family chooses to do so.

Benefits of Burial Insurance

Burial insurance offers several benefits that make it a valuable financial tool for individuals and their families:

-

Financial Relief: Burial insurance provides immediate financial relief to your family during a difficult time. It ensures that they won’t have to worry about covering the costs of your funeral and other final expenses out of their own pockets.

-

Peace of Mind: Knowing that your final expenses are taken care of can bring peace of mind to both you and your loved ones. It allows you to focus on living your life to the fullest without worrying about the financial burden your death may impose.

-

Affordable Premiums: Burial insurance policies often have relatively low premiums, making them accessible to individuals on a budget.

-

Simplified Application Process: Many burial insurance policies have a simplified application process with minimal health questions and no medical exam. This makes it easier for individuals with pre-existing health conditions to obtain coverage.

-

Guaranteed Acceptance Options: Some burial insurance policies offer guaranteed acceptance, ensuring that you can get coverage regardless of your health.

-

Tax Benefits: In many cases, the death benefit from a burial insurance policy is tax-free, providing additional financial benefits to your beneficiaries.

Who Needs Burial Insurance?

Burial insurance can be beneficial for a wide range of individuals, but it is particularly useful for:

-

Seniors: As people age, the likelihood of needing final expense coverage increases. Burial insurance can help seniors ensure that their families won’t be burdened with funeral costs.

-

Individuals with Pre-Existing Health Conditions: Those with health issues may find it challenging to obtain traditional life insurance. Burial insurance often has more lenient underwriting requirements.

-

Individuals on a Budget: Burial insurance policies are typically affordable, making them a practical choice for individuals with limited financial resources.

-

Those Who Want to Avoid Burdening Their Families: Many people want to ensure that their families are not financially burdened by their death. Burial insurance provides a way to achieve this goal.

Factors to Consider When Choosing Burial Insurance

When selecting a burial insurance policy, it’s essential to consider the following factors:

-

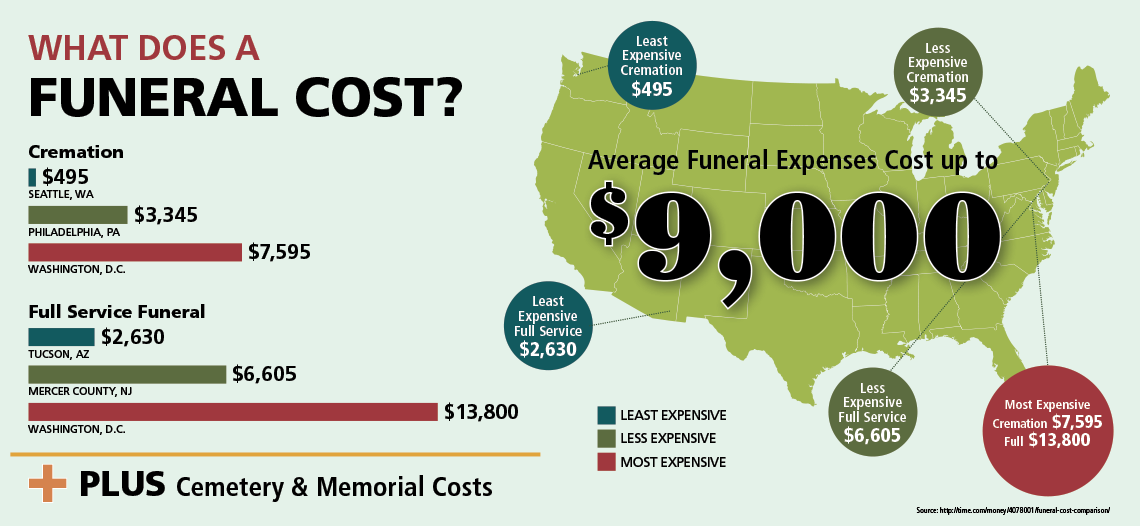

Coverage Amount: Determine how much coverage you need to cover your final expenses. Consider funeral costs, burial or cremation expenses, medical bills, and other potential costs.

-

Policy Type: Choose a policy type that aligns with your needs and health situation. Simplified issue and guaranteed acceptance policies may be suitable for those with health concerns.

-

Premiums: Compare premiums from different insurance companies to find a policy that fits your budget.

-

Waiting Periods: Be aware of any waiting periods before the full death benefit becomes available.

-

Insurance Company Reputation: Research the reputation and financial stability of the insurance company.

-

Policy Features: Consider additional policy features such as accelerated death benefits or riders that can enhance your coverage.

How to Apply for Burial Insurance

Applying for burial insurance typically involves the following steps:

-

Research: Research different insurance companies and policy options to find the best fit for your needs.

-

Get Quotes: Obtain quotes from multiple insurance companies to compare premiums and coverage options.

-

Complete an Application: Fill out an application, providing accurate information about your age, health, and desired coverage amount.

-

Underwriting: The insurance company will review your application and may require a medical exam or ask health-related questions.

-

Policy Approval: If your application is approved, you’ll receive a policy offer outlining the terms and conditions of the coverage.

-

Premium Payment: To activate the policy, you’ll need to make your initial premium payment.

Conclusion

Burial and final expense insurance is a valuable tool for ensuring that your final expenses are covered and that your family is not burdened with financial stress during a difficult time. By understanding how these policies work, their benefits, and the factors to consider when choosing a policy, you can make an informed decision that provides peace of mind for both you and your loved ones. Planning for the inevitable is a responsible and caring act, and burial insurance is an essential part of that planning process.