Company Overviews

Choosing the right life insurance provider requires careful consideration of several factors, including financial strength, product offerings, and target market. This section provides concise overviews of three major players: Northwestern Mutual, State Farm, and Prudential, highlighting their key characteristics to aid in your decision-making process.

Northwestern Mutual is a mutual company, meaning it’s owned by its policyholders, not shareholders. This structure often leads to a focus on long-term value and customer satisfaction. Established in 1857, it boasts a long history and a strong reputation for financial stability. Its primary focus is on high-net-worth individuals and families seeking permanent life insurance solutions. Northwestern Mutual consistently receives top financial strength ratings from major rating agencies, reflecting its robust financial position.

State Farm, known primarily for its auto and home insurance, also offers a diverse range of life insurance products. Its extensive agent network and broad customer base provide widespread accessibility. State Farm’s life insurance offerings cater to a broader spectrum of consumers, encompassing term life, whole life, and universal life insurance options, making it a viable option for various income levels and insurance needs. The company leverages its existing customer relationships to cross-sell life insurance products, further expanding its reach.

Prudential Financial, Inc., a global financial services leader, offers a comprehensive suite of life insurance products and other financial solutions. With a significant international presence, Prudential caters to a global customer base. Its product portfolio includes a wide array of life insurance options, annuities, and investment products, providing a one-stop shop for various financial planning needs. Prudential’s scale and global reach allow it to offer specialized products and services tailored to diverse markets and demographics.

Comparative Overview of Life Insurance Providers

The following table summarizes key aspects of Northwestern Mutual, State Farm, and Prudential:

| Company | Type of Insurance Offered | Financial Strength Rating (Illustrative – Check Current Ratings) | Target Market |

|---|---|---|---|

| Northwestern Mutual | Whole life, universal life, variable life, term life | AAA (Example – Check with rating agencies like A.M. Best, Moody’s, S&P) | High-net-worth individuals and families |

| State Farm | Term life, whole life, universal life, variable universal life | AA+ (Example – Check with rating agencies like A.M. Best, Moody’s, S&P) | Broad range of consumers, various income levels |

| Prudential | Term life, whole life, universal life, variable universal life, annuities, other financial products | AA+ (Example – Check with rating agencies like A.M. Best, Moody’s, S&P) | Global customer base, diverse income levels and needs |

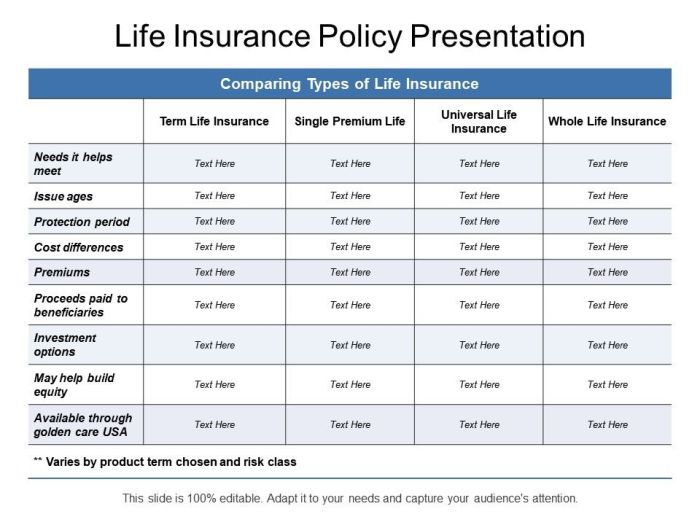

Product Comparisons

Choosing term life insurance requires careful consideration of coverage, cost, and policy features. This section directly compares the term life insurance offerings from Northwestern Mutual, State Farm, and Prudential, highlighting key differences in premiums, coverage amounts, and underwriting processes. Understanding these nuances is crucial for selecting the policy that best aligns with individual needs and financial circumstances.

Term Life Insurance Policy Features and Premiums

Northwestern Mutual, State Farm, and Prudential each offer a range of term life insurance policies with varying lengths and coverage amounts. However, direct premium comparisons are difficult without specific applicant details (age, health, smoking status, etc.), as these factors significantly impact pricing. Generally, Northwestern Mutual tends to be positioned at a higher price point, reflecting its reputation for high-quality service and financial strength. State Farm often offers more competitive premiums, leveraging its vast customer base and streamlined processes. Prudential occupies a middle ground, providing a balance between price and comprehensive coverage options. Policy features, such as riders (additional coverage options), also vary across providers and impact overall cost. For instance, some companies might offer more affordable term life insurance but limit the availability of crucial riders like accidental death benefit or terminal illness riders.

Underwriting Processes for Term Life Insurance

The underwriting process, the assessment of risk by the insurance company, differs among these three providers. Northwestern Mutual is known for a thorough and sometimes lengthier underwriting process, often involving more extensive medical evaluations. This rigorous approach allows them to assess risk accurately but can lead to longer waiting times for policy approval. State Farm’s underwriting is typically more streamlined, often relying on simplified application processes and less extensive medical information. This can result in faster approvals but may involve a less nuanced risk assessment. Prudential’s underwriting process generally falls between these two extremes, balancing thoroughness with efficiency. The specific requirements and the speed of the process will vary depending on the applicant’s health and the amount of coverage sought.

Advantages and Disadvantages of Each Company’s Term Life Insurance Offering

Understanding the strengths and weaknesses of each company’s term life insurance offering is critical for informed decision-making.

- Northwestern Mutual:

- Advantages: High financial strength and stability; excellent customer service; potentially more comprehensive policy options and riders.

- Disadvantages: Higher premiums; more rigorous underwriting process; may take longer to get policy approval.

- State Farm:

- Advantages: Generally lower premiums; streamlined and efficient underwriting process; convenient access through established agent network.

- Disadvantages: Potentially less comprehensive policy options compared to Northwestern Mutual; underwriting may be less thorough.

- Prudential:

- Advantages: Balance between price and comprehensive coverage; established reputation; wide range of policy options.

- Disadvantages: Premiums may be higher than State Farm, but lower than Northwestern Mutual; underwriting process may be less efficient than State Farm.

Product Comparisons

Whole life insurance offers a blend of death benefit and cash value accumulation, making it a complex product to compare across providers like Northwestern Mutual, State Farm, and Prudential. Understanding the nuances of cash value growth, death benefit payouts, and long-term costs is crucial for making an informed decision. This section will delve into a direct comparison of whole life insurance policies from these three major providers.

Whole Life Insurance Policy Features

Each company offers variations within their whole life product lines, catering to different needs and risk profiles. Northwestern Mutual is known for its strong financial strength and personalized service, often resulting in higher premiums. State Farm provides a broader range of insurance products, offering potentially more competitive pricing but possibly less personalized service. Prudential, a large and established insurer, generally falls somewhere between the two in terms of both price and service. Comparing specific policies requires careful consideration of the individual policy details, as features and benefits can vary significantly even within a single company’s offerings. The cash value accumulation rates are not fixed and depend on several factors, including the interest rates and the company’s investment performance. Death benefits are typically fixed but may have riders that modify the payout. Long-term costs are influenced by the premium payment schedule, policy features, and underlying investment performance.

Tax Implications of Whole Life Insurance

The tax advantages of whole life insurance policies can be significant. Cash value growth generally accumulates tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them. Death benefits are typically paid income tax-free to beneficiaries. However, certain withdrawals or loans against the cash value may be subject to taxes and penalties, depending on the specific policy and the circumstances of the withdrawal. It’s essential to consult a tax professional for personalized advice, as tax laws are complex and can change. Understanding these tax implications is crucial for evaluating the overall long-term cost-effectiveness of each policy.

Comparative Table: Whole Life Insurance Policies

The following table compares hypothetical whole life insurance policies from Northwestern Mutual, State Farm, and Prudential, for a $500,000 death benefit. Note that these are illustrative examples only and actual premiums and cash value growth rates will vary depending on individual factors such as age, health, and policy features. It is crucial to obtain personalized quotes from each company for an accurate comparison.

| Company | Policy Name | Cash Value Growth Rate (Illustrative Annual Average) | Annual Premium (Illustrative) |

|---|---|---|---|

| Northwestern Mutual | (Example Policy Name – Specific policy details needed for accurate information) | 3.5% | $5,000 |

| State Farm | (Example Policy Name – Specific policy details needed for accurate information) | 3.0% | $4,500 |

| Prudential | (Example Policy Name – Specific policy details needed for accurate information) | 3.2% | $4,750 |

Customer Service and Claims Process

Choosing a life insurance provider involves careful consideration of various factors, and understanding the quality of customer service and the efficiency of the claims process is paramount. A smooth and responsive experience during these crucial interactions can significantly impact overall satisfaction. This section analyzes customer service and claims processes for Northwestern Mutual, State Farm, and Prudential, drawing upon publicly available customer reviews and industry reports.

Northwestern Mutual Customer Service and Claims Process

Customer reviews regarding Northwestern Mutual often highlight the personalized service provided by their financial advisors. However, some users mention longer wait times for responses compared to other providers, especially for non-advisor related inquiries. The claims process is generally considered thorough but can be lengthy, requiring substantial documentation.

- Positive Aspects: Personalized service from financial advisors, comprehensive claim support, detailed guidance throughout the process.

- Negative Aspects: Potentially longer wait times for responses to inquiries, extensive documentation required for claims, the process may feel bureaucratic to some.

State Farm Customer Service and Claims Process

State Farm, known for its broad range of insurance products, generally receives positive feedback for its accessible customer service. Many reviewers praise the ease of contacting representatives and the responsiveness of their support channels. The claims process is often described as relatively straightforward, though the specifics can vary depending on the type of claim.

- Positive Aspects: Easy accessibility to customer service representatives, generally quick response times, relatively streamlined claims process.

- Negative Aspects: Some users report inconsistencies in service quality depending on the representative or location, potential for delays in complex claims.

Prudential Customer Service and Claims Process

Prudential’s customer service experiences are mixed. While some users report positive interactions and helpful representatives, others mention difficulties reaching someone or experiencing long wait times. The claims process, like other providers, requires thorough documentation and can involve several steps. Processing times are generally reported to be within industry standards, but individual experiences may vary.

- Positive Aspects: Availability of multiple communication channels (phone, online), generally comprehensive claim support, clear guidelines for the claims process.

- Negative Aspects: Reports of inconsistent customer service experiences, potential for long wait times, the complexity of the process may be overwhelming for some.

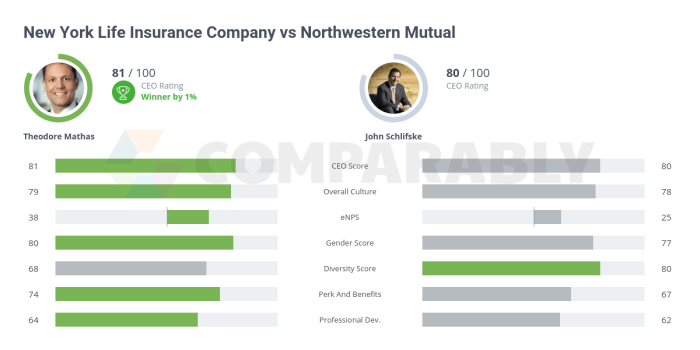

Financial Strength and Stability

Choosing a life insurance provider requires careful consideration of their financial strength and stability. A company’s ability to pay out claims when needed is paramount, and this directly relates to its financial health. Understanding the financial ratings assigned by reputable agencies provides crucial insight into a company’s long-term viability and its capacity to fulfill its promises to policyholders.

Financial strength ratings from independent agencies such as A.M. Best, Moody’s, Standard & Poor’s, and Fitch are crucial indicators of a life insurer’s ability to meet its obligations. These ratings assess factors like a company’s capital reserves, investment performance, underwriting practices, and overall financial health. A higher rating generally indicates a greater likelihood that the company will be able to pay out death benefits and other policy benefits as promised.

Financial Strength Ratings of Northwestern Mutual, State Farm, and Prudential

The financial strength of Northwestern Mutual, State Farm, and Prudential is consistently high, reflecting their long history and established market positions. However, specific ratings can fluctuate slightly over time. To illustrate, consider a hypothetical visual representation: a line graph showing the financial strength ratings of each company over a ten-year period (2014-2024). The y-axis would represent the rating scale (e.g., A++, A+, A, etc., as used by A.M. Best), and the x-axis would represent the years. Each company would be represented by a different colored line, allowing for easy comparison of their rating trends. Generally, all three companies would show consistent high ratings throughout the period, with minor fluctuations possibly reflecting market conditions or internal adjustments. For instance, a temporary dip in one company’s rating during a particular year might be attributable to a specific economic downturn or a large payout of claims related to a particular event. The graph would clearly show that all three maintain strong financial standing over the long term.

Agent Network and Accessibility

Choosing a life insurance provider often involves personal interaction with an agent. The accessibility and quality of the agent network significantly impact the overall customer experience. This section compares Northwestern Mutual, State Farm, and Prudential regarding their agent networks, training, and the typical client interactions.

Each company employs a different approach to its agent network, impacting geographical reach and ease of contact. Northwestern Mutual, known for its high-net-worth clientele, generally has a more limited agent network compared to the broader reach of State Farm and Prudential. However, the quality of training and support often differs across these models.

Agent Network Geographic Reach and Contact Ease

Northwestern Mutual’s agents are typically found in more affluent areas and larger cities. Scheduling an appointment may require more effort due to the higher demand for their services. State Farm, with its extensive network, boasts a significantly wider geographical reach, making it easier to find an agent in most locations. Prudential falls somewhere in between, offering good geographic coverage but potentially with less density in certain rural areas than State Farm. Contacting agents varies; State Farm often offers online appointment scheduling and multiple contact methods, while Northwestern Mutual might rely more on traditional methods.

Agent Training and Support

Northwestern Mutual invests heavily in agent training and development, known for its rigorous curriculum and ongoing support. This translates to agents with a deep understanding of financial planning and complex life insurance products. State Farm also provides extensive training, though the focus might be broader, encompassing a wider range of insurance products beyond just life insurance. Prudential’s training programs are comprehensive, but the specific focus and depth might vary depending on the agent’s specialization and experience level. The level of ongoing support also varies; Northwestern Mutual often provides more robust ongoing mentorship and professional development opportunities.

Typical Client Experience with Agents

The client experience differs across the three companies. Northwestern Mutual clients often report a more personalized and high-touch service, with agents acting as financial advisors offering comprehensive planning. This often comes with a higher level of agent involvement and potentially longer appointment durations. State Farm clients generally experience a more streamlined and efficient process, focusing on straightforward product selection and policy management. Prudential offers a balance, providing a personalized approach but with potentially quicker response times compared to Northwestern Mutual. The level of proactive communication also varies; Northwestern Mutual agents may initiate more frequent contact for reviews and updates, while State Farm and Prudential may rely more on scheduled interactions.

Pricing and Value Proposition

Understanding the pricing and value proposition of Northwestern Mutual, State Farm, and Prudential life insurance requires a nuanced look at premiums, benefits, and the factors influencing each. While direct price comparisons are difficult without specific policy details (age, health, coverage amount, etc.), we can examine general pricing trends and the value each company offers.

Factors influencing pricing across all three companies include the applicant’s age, health status, smoking habits, desired coverage amount, policy type (term, whole, universal), and the chosen riders or add-ons. Each company uses its own proprietary underwriting models and risk assessment methods, leading to variations in pricing even for similar profiles. Additionally, the company’s financial strength and operating costs impact premiums.

Premium and Benefit Comparison

A 35-year-old male, in good health, seeking a $500,000 20-year term life insurance policy might receive quotes ranging from approximately $25 to $50 per month from each company. However, this is a broad estimate, and the actual price will vary depending on the specific policy features and underwriting assessment. Northwestern Mutual, known for its high-end, personalized service, might offer a slightly higher premium compared to State Farm, which often focuses on broader market reach and potentially lower costs. Prudential typically falls somewhere in between, offering a range of products to cater to different needs and budgets. Beyond premiums, the value proposition extends to the specific benefits offered, such as accelerated death benefits, riders for chronic illness, and the financial strength and stability of the issuing company.

Total Cost of Ownership Calculation

To illustrate total cost of ownership, let’s consider the hypothetical 20-year term policy mentioned above. Assuming an average monthly premium of $35 for each company, the total premium paid over 20 years would be $8,400 ($35/month * 12 months/year * 20 years). This is a simplified calculation, and does not factor in potential policy fees or changes in premium rates over time. A more comprehensive analysis would involve obtaining detailed policy illustrations from each company, including any potential fees or charges. The true “value” is determined by comparing the total cost to the death benefit received if a claim is made. In this case, the $500,000 death benefit significantly outweighs the premium cost, demonstrating the value proposition of life insurance.

Factors Influencing Pricing Across Companies

Several factors contribute to pricing differences. Northwestern Mutual’s emphasis on financial advisors and personalized service might translate to slightly higher premiums, reflecting the personalized attention and comprehensive financial planning offered. State Farm, with its large scale and direct-to-consumer approach, may achieve economies of scale, resulting in potentially lower premiums. Prudential’s diverse product offerings and market position allow them to offer competitive pricing across various segments. Finally, each company’s investment strategies and risk management practices also play a significant role in shaping their pricing models. Understanding these underlying factors is crucial for making an informed decision.