Understanding Millennial and Gen Z Financial Needs

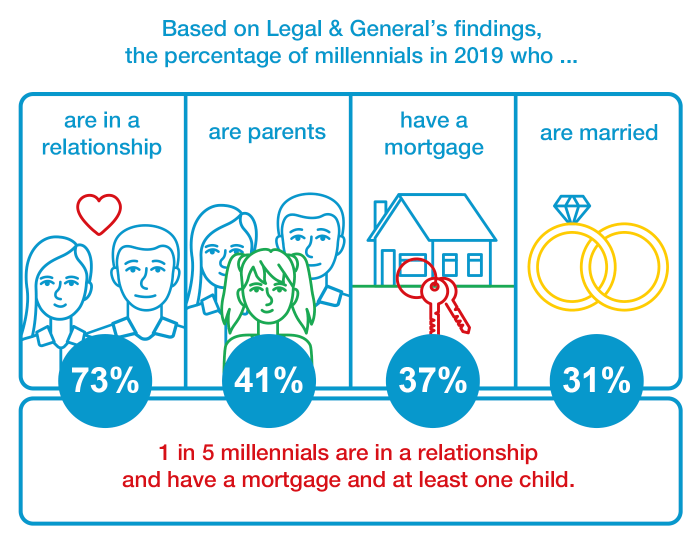

Millennials (born 1981-1996) and Gen Z (born 1997-2012) represent a significant portion of the population and are increasingly important to the life insurance market. Understanding their unique financial situations and priorities is crucial for tailoring appropriate insurance products and services. Their financial realities differ significantly from previous generations, impacting their approach to life insurance.

Key Financial Priorities of Millennials and Gen Z

Millennials and Gen Z prioritize experiences and financial stability. While homeownership remains a goal, it’s often delayed compared to previous generations due to factors like student loan debt and fluctuating housing markets. Instead, they focus on immediate financial needs such as paying off debt, saving for travel, and building an emergency fund. Investing, though important, often takes a backseat to these immediate priorities. A strong emphasis is placed on financial security, but their approach reflects a more cautious and pragmatic outlook shaped by economic instability witnessed during their formative years.

Unique Life Insurance Needs of Millennials and Gen Z

Unlike older generations who might prioritize life insurance primarily for estate planning, millennials and Gen Z often view it as a crucial component of financial security and debt management. The significant student loan debt many carry makes life insurance a tool to protect their families from the burden of these loans in the event of their death. Furthermore, the increasing prevalence of gig work and freelance opportunities necessitates life insurance to provide income replacement for dependents. They are also more likely to consider life insurance as a component of a broader financial plan encompassing retirement savings and investments.

Income Levels and Debt Burdens and Their Influence on Insurance Choices

Millennials and Gen Z face varying income levels, often impacted by the economic climate and career paths. While some enjoy high incomes, many grapple with student loan debt, high housing costs, and other financial obligations. This debt burden significantly influences their insurance choices, often leading them to opt for more affordable term life insurance policies rather than expensive whole life policies. Their income levels, combined with debt, directly affect their ability to afford higher premiums and influence their preference for policies with shorter durations and lower premiums. For example, a millennial with significant student loan debt might choose a 10-year term life insurance policy to cover the loan repayment period, while someone with a stable income and fewer debts might opt for a longer-term policy.

Comparison of Financial Situations and Life Insurance Needs

| Demographic | Typical Income | Debt Burden | Life Insurance Needs |

|---|---|---|---|

| Millennials | Variable, often lower than previous generations in early career stages, increasing with experience | High student loan debt, potential credit card debt, and mortgages | Term life insurance to cover debt, income replacement for dependents, potentially supplemental disability insurance |

| Gen Z | Generally lower than Millennials at early career stages, increasing gradually | Student loan debt, potential credit card debt | Term life insurance, focusing on debt coverage and income replacement; possibly exploring digital-first insurance options |

Types of Life Insurance Suitable for Millennials and Gen Z

Choosing the right life insurance policy is a crucial financial decision, especially for young adults. Millennials and Gen Z face unique challenges and opportunities, requiring a careful consideration of different policy types to meet their specific needs and goals. Understanding the nuances of term life, whole life, and universal life insurance is key to making an informed choice.

Term Life Insurance for Millennials and Gen Z

Term life insurance provides coverage for a specific period, or “term,” typically ranging from 10 to 30 years. It’s generally the most affordable option, making it attractive to young adults who may be on a tighter budget. The premiums remain level throughout the term, offering predictable costs. However, coverage ends at the end of the term, unless renewed (often at a higher rate). This makes it ideal for those needing temporary coverage, such as during periods of high debt or when supporting young children.

- Pros: Affordable premiums, straightforward coverage, predictable costs.

- Cons: Coverage expires at the end of the term; premiums increase significantly upon renewal (if possible); no cash value accumulation.

Whole Life Insurance for Millennials and Gen Z

Whole life insurance offers lifelong coverage, providing protection for the policyholder’s entire life. It also builds cash value over time, which can be borrowed against or withdrawn. However, premiums are typically higher than term life insurance, making it a less accessible option for those starting their careers. The cash value component can grow tax-deferred, offering a potential long-term investment benefit.

- Pros: Lifelong coverage, cash value accumulation, potential for tax-deferred growth.

- Cons: Higher premiums compared to term life, less affordable for younger adults with limited budgets, cash value growth may not always outpace inflation.

Universal Life Insurance for Millennials and Gen Z

Universal life insurance combines lifelong coverage with a flexible premium payment structure. Policyholders can adjust their premium payments within certain limits, allowing for greater adaptability to changing financial circumstances. Like whole life, it builds cash value, though the growth rate can vary depending on the market performance of the underlying investments. This flexibility comes at the cost of higher complexity compared to term life insurance.

- Pros: Lifelong coverage, flexible premium payments, cash value accumulation.

- Cons: More complex than term life insurance, premiums can fluctuate, potential for higher costs if not managed carefully.

Real-Life Scenarios and Suitable Insurance Types

Consider a millennial couple with a new mortgage and a young child. A 20-year term life insurance policy would provide sufficient coverage during their highest debt burden and child-rearing years, offering affordable protection. Conversely, a high-earning individual with significant assets might benefit from a whole life policy to ensure lifelong protection and create a lasting legacy for their heirs. A self-employed millennial with fluctuating income might find the flexibility of a universal life policy more suitable, allowing them to adjust premiums based on their yearly earnings.

Factors to Consider When Choosing a Life Insurance Company

Selecting the right life insurance provider is a crucial decision impacting your family’s financial security. Several key factors must be carefully evaluated to ensure you choose a company that offers both reliable coverage and a positive customer experience. This involves examining the insurer’s financial stability, reputation, customer service capabilities, and the availability of user-friendly digital tools.

Financial Stability and Reputation

A life insurance company’s financial strength is paramount. You need assurance that the company will be able to pay out claims when the time comes. Look for companies with high ratings from independent financial rating agencies like A.M. Best, Moody’s, Standard & Poor’s, and Fitch. These agencies assess insurers’ financial health, evaluating factors such as their reserves, investment performance, and overall solvency. A high rating indicates a lower risk of the company failing to meet its obligations. Beyond ratings, research the company’s history, looking for any significant negative events or controversies that might raise concerns about their reliability. A long-standing reputation for stability and ethical practices should be a primary consideration.

Customer Service and Claim Processing Efficiency

Exceptional customer service is vital, particularly during stressful times. Consider a company with readily available support channels, such as phone, email, and online chat. Read customer reviews to gauge the responsiveness and helpfulness of the company’s customer service representatives. Efficient claim processing is equally crucial. Delays in claim payouts can cause significant financial hardship for your beneficiaries. Look for companies known for their streamlined and transparent claim processes, with clear guidelines and readily available support during the claims process. Investigate the company’s average claim processing time and the overall customer satisfaction with the claims experience.

Online Resources and Digital Tools

In today’s digital age, life insurance companies should offer convenient online resources and tools. A user-friendly website with easy-to-navigate information, online quote tools, and secure online account management is essential. The ability to manage your policy online, access documents, and make payments digitally simplifies the process significantly. Consider companies offering mobile apps for policy management and communication. These digital tools can save you time and effort, making the overall insurance experience more efficient and user-friendly. The availability of educational resources and FAQs on the company’s website can also be beneficial in understanding your policy and options.

Comparison of Key Factors for Top Life Insurance Companies

| Company | Financial Strength Rating (A.M. Best) | Customer Reviews (Example Source) | Digital Tools & Resources |

|---|---|---|---|

| Company A | A++ | 4.5 stars (Based on independent reviews from Trustpilot) | Robust online portal, mobile app, comprehensive FAQs |

| Company B | A+ | 4.2 stars (Based on independent reviews from ConsumerAffairs) | Online quote tool, secure online account access |

| Company C | A | 4 stars (Based on independent reviews from NerdWallet) | Basic online portal, limited mobile app functionality |

| Company D | A- | 3.8 stars (Based on independent reviews from J.D. Power) | Online account access, email support |

Top Life Insurance Companies and Their Offerings

Choosing the right life insurance provider can be a daunting task, especially for millennials and Gen Z who are navigating early career stages and building their financial futures. This section highlights several leading companies known for their millennial- and Gen Z-friendly policies, pricing, and customer service. Understanding their offerings is crucial for making informed decisions about securing financial protection for loved ones.

Leading Life Insurance Companies for Younger Generations

Several companies stand out for their innovative approaches to life insurance, catering specifically to the needs and preferences of younger generations. These companies often emphasize digital accessibility, streamlined processes, and flexible policy options to appeal to tech-savvy individuals who prefer convenient and transparent services.

Policy Options, Pricing, and Customer Support: Company A (Example: A Hypothetical Company Focused on Digital Experience)

Company A prioritizes a fully digital experience. Their policy options include term life insurance, with varying lengths and coverage amounts readily customizable through their user-friendly online platform. Pricing is transparently displayed online, allowing users to obtain instant quotes based on their age, health, and desired coverage. Customer support is primarily offered through a comprehensive online help center, live chat, and email, mirroring the preferences of digitally native consumers. They offer educational resources and financial planning tools directly integrated into their platform, fostering financial literacy among their younger customer base.

Policy Options, Pricing, and Customer Support: Company B (Example: A Hypothetical Company Emphasizing Flexibility)

Company B focuses on flexible policy options, recognizing the evolving life circumstances of millennials and Gen Z. They offer term life insurance with the ability to adjust coverage amounts and policy lengths as needed, accommodating career changes, family growth, and other life events. Pricing is competitive and often incorporates discounts for healthy lifestyle choices, promoting wellness and financial responsibility. Customer support is available through multiple channels, including phone, email, and online chat, with dedicated agents trained to address the unique financial concerns of younger clients. They provide personalized financial planning guidance and proactively offer policy adjustments based on life changes.

Policy Options, Pricing, and Customer Support: Company C (Example: A Hypothetical Company with a Strong Social Impact Focus)

Company C distinguishes itself through its commitment to social responsibility. Beyond offering standard term and whole life insurance policies with competitive pricing, they partner with various charitable organizations, allowing policyholders to donate a portion of their premiums to causes they support. This aligns with the social consciousness often prevalent among younger generations. Customer support emphasizes personalized service and proactive communication, focusing on building lasting relationships with clients. They offer educational workshops and online resources to promote financial literacy and responsible money management.

Summary of Key Features and Benefits

| Company | Policy Options | Pricing | Customer Support |

|---|---|---|---|

| Company A | Term life insurance (digital customization) | Transparent online quotes | Digital help center, live chat, email |

| Company B | Term life insurance (adjustable coverage & length) | Competitive, with wellness discounts | Phone, email, online chat, personalized guidance |

| Company C | Term and whole life insurance, social impact options | Competitive | Personalized service, proactive communication, educational resources |

Illustrative Examples of Policy Selection

Choosing the right life insurance policy is a crucial financial decision, particularly for Millennials and Gen Z who are navigating career building, family planning, and significant debt. Understanding individual circumstances and aligning them with appropriate coverage is paramount. This section provides hypothetical scenarios to illustrate practical policy selection.

Millennial Scenario: Sarah, the Aspiring Entrepreneur

Sarah, a 30-year-old millennial, is a freelance graphic designer with a stable income but fluctuating earnings. She recently purchased a condo and has student loan debt. She is single but plans to start a family in the next few years. Sarah needs life insurance to protect her assets and provide for her future family. Her primary concern is affordability and sufficient coverage to meet her financial obligations in case of an unexpected event.

A suitable policy for Sarah would be a 20-year term life insurance policy with a relatively high death benefit, considering her mortgage and potential future childcare costs. A company like Haven Life, known for its digital-first approach and competitive pricing, could be a good fit, offering straightforward online applications and transparent pricing. The term life insurance aligns with her current needs, providing affordable coverage for a specific period, allowing her to adjust her policy later as her financial situation and family circumstances evolve. The online application process with Haven Life suits her busy lifestyle.

Gen Z Scenario: David, the Recent Graduate

David, a 22-year-old recent college graduate, has minimal debt and a stable entry-level job. He is focused on paying off his student loans and saving for a down payment on a house. He is single and does not yet have dependents. David needs life insurance primarily to cover his student loans and ensure his family won’t be burdened by his debts in case of his death. He also wants to ensure he can leave a small inheritance to his family.

For David, a smaller term life insurance policy, perhaps a 10-year term, could be appropriate, given his current financial situation and lower debt burden compared to Sarah. A company like Lemonade, known for its simple and quick application process and low premiums, could be a suitable option. The shorter term and lower coverage are appropriate for his current needs, offering affordable protection without unnecessary expense. Lemonade’s user-friendly app and quick claim process are appealing to his tech-savvy generation.

Visual Representation of Policy Choices

The visual representation would be a comparative bar chart. The horizontal axis would represent the two individuals, Sarah and David. The vertical axis would represent the policy features: death benefit amount, policy term length, and premium cost. Sarah’s bars would be significantly taller for the death benefit, reflecting her higher coverage needs, and longer for the policy term (20 years vs. 10 years). Her premium cost bar would also be taller than David’s, reflecting the higher coverage. David’s bars would be shorter for death benefit and policy term, but his premium cost would be significantly shorter, indicating a lower premium cost. The chart clearly illustrates the differences in policy choices based on individual needs and financial circumstances. Different colors could be used for each individual to further enhance clarity.

Addressing Concerns and Misconceptions

Millennials and Gen Z often harbor misconceptions about life insurance, leading to procrastination and a lack of adequate coverage. These misconceptions, coupled with financial pressures common to younger generations, create significant barriers to securing essential life insurance. Addressing these concerns head-on is crucial for promoting financial well-being and future security.

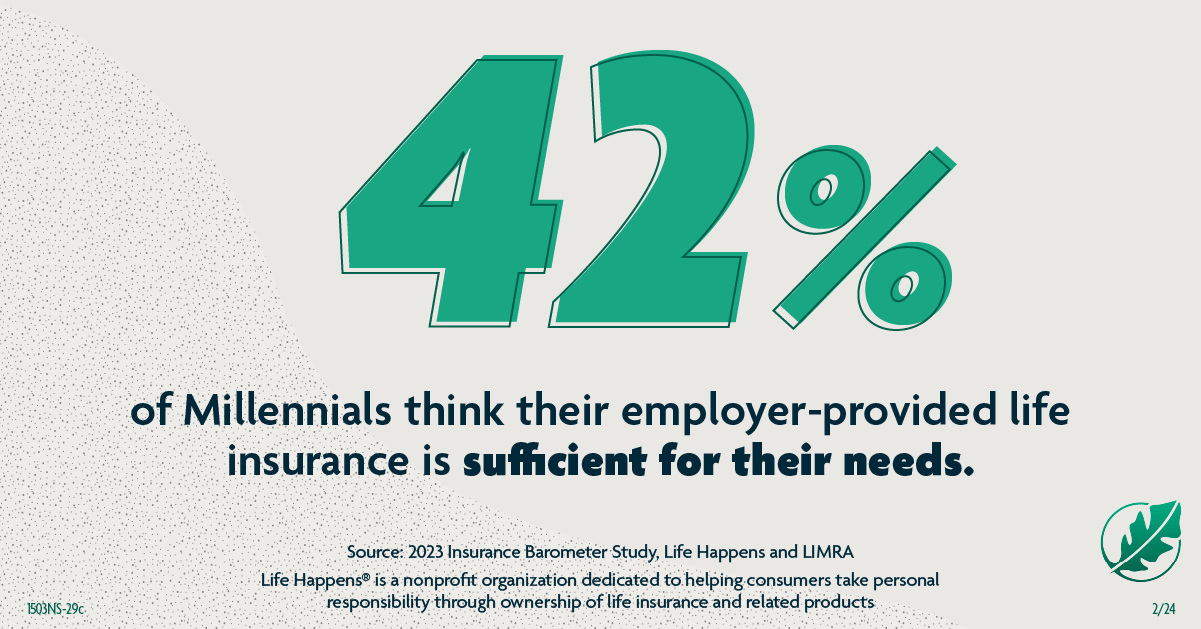

Common misconceptions surrounding life insurance among younger generations frequently involve perceived high costs, unnecessary complexity, and a belief that it’s only relevant for older individuals with families. This lack of understanding often results in delayed planning, potentially leaving loved ones vulnerable in the event of unforeseen circumstances. Early planning, however, offers significant long-term advantages, including lower premiums and greater financial protection throughout life’s various stages.

Common Misconceptions About Life Insurance

Many young adults believe life insurance is too expensive or complicated to understand. They may underestimate the long-term value of securing coverage early, focusing instead on immediate financial priorities. Others may wrongly assume they don’t need life insurance due to their current financial situation, neglecting the potential impact on dependents or outstanding debts in case of unexpected death. This lack of awareness can lead to significant financial hardship for surviving family members or creditors.

The Importance of Early Planning and Long-Term Benefits

Securing life insurance early offers considerable advantages. Younger individuals typically qualify for lower premiums due to their lower risk profiles. This means that the cost of coverage is significantly less when purchased at a younger age compared to later in life. Furthermore, early planning allows for a longer period of coverage, accumulating greater value over time and providing financial security across various life stages, from starting a family to providing for retirement. For example, a 25-year-old securing a term life insurance policy will pay considerably less than a 45-year-old with the same coverage needs. The accumulated value of early planning provides a substantial safety net that grows with each passing year.

Strategies for Overcoming Financial Barriers

Financial constraints are a common obstacle for millennials and Gen Z when considering life insurance. However, several strategies can help overcome these barriers. Exploring affordable options like term life insurance, which offers coverage for a specified period at a lower cost than permanent life insurance, is a viable solution. Additionally, increasing income through additional employment or improved financial management can improve affordability. Breaking down the cost of premiums into smaller, manageable monthly payments can also make the commitment more attainable. Finally, seeking professional financial advice can provide personalized guidance and support in navigating these financial challenges and identifying the most suitable life insurance plan.

Addressing Concerns About Cost and Complexity

Life insurance doesn’t have to be a daunting financial burden. By exploring different policy types and understanding your specific needs, you can find an affordable and suitable plan. Don’t hesitate to seek professional guidance; financial advisors can help simplify the process and ensure you have the right coverage. Remember, the cost of not having life insurance far outweighs the cost of securing it.