The Truth About Low-Cost Online Life Insurance: Is It Right for You?

In today’s digital age, convenience and affordability reign supreme. It’s no surprise, then, that low-cost online life insurance has become an increasingly popular option for individuals and families seeking financial protection. The promise of quick quotes, easy applications, and budget-friendly premiums is certainly appealing. But before you jump on the bandwagon, it’s crucial to understand the full picture. This article delves into the truth about low-cost online life insurance, exploring its benefits, drawbacks, and essential considerations to help you determine if it’s the right fit for your needs.

The Allure of Low-Cost Online Life Insurance

Let’s face it: life insurance isn’t the most exciting topic. Many people put it off, either because they’re unsure of their needs or they assume it’s too expensive. Low-cost online life insurance aims to break down these barriers by offering:

- Accessibility: Online platforms are available 24/7, allowing you to research and apply for coverage at your own pace and convenience.

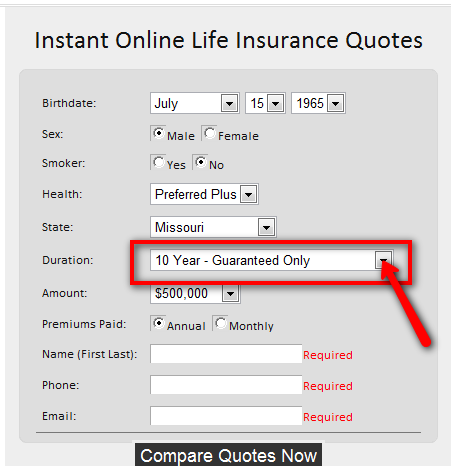

- Speed: Forget lengthy meetings with insurance agents. Online applications can often be completed in minutes, with instant quotes and, in some cases, even immediate approval.

- Transparency: Comparison shopping is a breeze. You can easily compare quotes from multiple insurers side-by-side, giving you a clear view of available options and pricing.

- Affordability: By cutting out the middleman (traditional insurance agents), online providers can often offer lower premiums than traditional insurance companies.

These advantages have made low-cost online life insurance an attractive option for:

- Young Adults: Starting their careers and families, often on a tight budget.

- Individuals with Simple Needs: Seeking basic term life coverage to protect loved ones in case of their untimely death.

- Tech-Savvy Consumers: Comfortable with online research and transactions.

The Different Types of Online Life Insurance

Before diving deeper, it’s essential to understand the different types of life insurance you can find online:

- Term Life Insurance: The most straightforward and often the most affordable type. It provides coverage for a specific period (e.g., 10, 20, or 30 years). If you die within the term, your beneficiaries receive a death benefit. If the term expires and you’re still alive, the coverage ends (unless you renew, which usually comes at a higher premium).

- Whole Life Insurance: A type of permanent life insurance that provides lifelong coverage. It also includes a cash value component that grows over time on a tax-deferred basis. Whole life policies are generally more expensive than term life.

- Simplified Issue Life Insurance: A type of life insurance that typically doesn’t require a medical exam. Instead, you’ll answer a questionnaire about your health. Because the insurer takes on more risk, premiums are usually higher than fully underwritten policies.

- Guaranteed Issue Life Insurance: A type of life insurance that doesn’t require a medical exam or health questionnaire. Acceptance is guaranteed, regardless of your health. However, coverage amounts are usually limited, and premiums are higher than other types of life insurance.

The Potential Downsides of Low-Cost Online Life Insurance

While the benefits of low-cost online life insurance are clear, it’s crucial to be aware of the potential drawbacks:

- Limited Coverage Options: Some online providers may only offer a limited range of policy types or coverage amounts. If you have complex financial needs or require a large death benefit, you may need to look elsewhere.

- Lack of Personalized Advice: Unlike working with a traditional insurance agent, you won’t receive personalized advice or guidance. You’ll need to do your own research and determine the right coverage for your specific situation.

- Underwriting Concerns: While some online providers offer instant approval, many require a full underwriting process, including a medical exam. If you have pre-existing health conditions, you may face higher premiums or even be denied coverage.

- Customer Service Issues: Some online providers may have limited customer service support. If you have questions or need assistance, you may have difficulty getting in touch with a representative.

- Hidden Fees and Fine Print: Always read the policy documents carefully to understand any hidden fees or limitations. Some policies may have exclusions or waiting periods that could affect your coverage.

Factors Affecting the Cost of Online Life Insurance

The cost of online life insurance depends on a variety of factors, including:

- Age: Younger applicants generally pay lower premiums.

- Gender: Women typically pay less than men due to their longer life expectancy.

- Health: Your health history and current health status are major factors. Pre-existing conditions can increase your premiums or even lead to denial of coverage.

- Lifestyle: Risky behaviors, such as smoking or extreme sports, can increase your premiums.

- Coverage Amount: The larger the death benefit, the higher the premium.

- Policy Type: Term life insurance is generally cheaper than whole life insurance.

- Policy Length (for Term Life): Longer terms usually result in higher premiums.

How to Find the Best Low-Cost Online Life Insurance

If you’re considering low-cost online life insurance, here are some tips for finding the best policy for your needs:

- Determine Your Coverage Needs: Before you start shopping, calculate how much coverage you need. Consider factors such as your debts, income, and future financial obligations (e.g., college expenses for your children).

- Compare Quotes from Multiple Insurers: Don’t settle for the first quote you receive. Use online comparison tools to compare quotes from multiple insurers.

- Check the Insurer’s Financial Strength: Make sure the insurer is financially stable and has a good reputation for paying claims. You can check ratings from agencies like A.M. Best, Standard & Poor’s, and Moody’s.

- Read the Policy Documents Carefully: Before you sign up for a policy, read the fine print. Understand the terms and conditions, exclusions, and any waiting periods.

- Be Honest on Your Application: Don’t try to hide any health conditions or risky behaviors. This could lead to your policy being canceled or your claim being denied.

- Consider Working with an Independent Broker: If you’re unsure about your needs or overwhelmed by the options, consider working with an independent insurance broker. They can help you compare policies from multiple insurers and find the best coverage for your situation.

- Ask Questions: Don’t hesitate to ask questions about the policy or the insurer. A reputable provider will be happy to answer your questions and address any concerns.

When Low-Cost Online Life Insurance Might Not Be the Best Choice

While low-cost online life insurance can be a great option for many people, it’s not always the best choice. Consider these situations:

- Complex Financial Needs: If you have complex financial needs, such as estate planning or business succession planning, you may need a more comprehensive policy and personalized advice from a financial advisor.

- Pre-Existing Health Conditions: If you have pre-existing health conditions, you may find it difficult to get affordable coverage online. You may need to work with an agent who specializes in high-risk life insurance.

- Need for Permanent Coverage: If you need lifelong coverage, term life insurance may not be the best option. Whole life insurance or other permanent policies may be more suitable.

- Preference for Personal Interaction: If you prefer to work with a person face-to-face, you may be better off working with a traditional insurance agent.

The Future of Online Life Insurance

The online life insurance market is constantly evolving. As technology advances, we can expect to see even more innovative products and services, such as:

- AI-Powered Underwriting: Artificial intelligence is being used to streamline the underwriting process and make it faster and more accurate.

- Personalized Policies: Insurers are using data analytics to create more personalized policies that are tailored to individual needs.

- Wearable Technology Integration: Some insurers are exploring the use of wearable technology to track health and fitness data, which could lead to lower premiums for healthy individuals.

Conclusion

Low-cost online life insurance can be a convenient and affordable way to protect your loved ones. However, it’s essential to understand the potential drawbacks and to do your research before you sign up for a policy. By carefully considering your needs, comparing quotes, and reading the fine print, you can find the best coverage for your situation. Remember, life insurance is an important investment in your family’s future, so take the time to make an informed decision.