How Term Life Insurance Can Save You Thousands: A Comprehensive Guide

Life insurance. It’s a topic that many people avoid, often associated with uncomfortable thoughts about mortality and financial planning for the unknown. However, understanding the role of life insurance, particularly term life insurance, is crucial for responsible financial management and securing your family’s future. While the idea of paying premiums may seem like an expense, term life insurance can actually save you thousands of dollars in the long run, providing a safety net that protects against potential financial disasters.

Understanding Term Life Insurance: The Basics

Before diving into the savings aspect, let’s clarify what term life insurance is and how it works.

Term life insurance is a type of life insurance that provides coverage for a specific period, or "term," such as 10, 20, or 30 years. If the insured person dies within this term, the insurance company pays a death benefit to the beneficiaries named in the policy. If the term expires and the policyholder is still alive, the coverage ends, unless the policy is renewed or converted.

Key characteristics of term life insurance:

- Fixed Term: Coverage lasts for a specific period.

- Death Benefit: Pays out a predetermined amount upon the insured’s death during the term.

- Premiums: Generally lower than permanent life insurance, especially at younger ages.

- No Cash Value: Unlike whole life insurance, term life insurance does not accumulate cash value.

- Renewable/Convertible: Some policies can be renewed or converted to permanent life insurance.

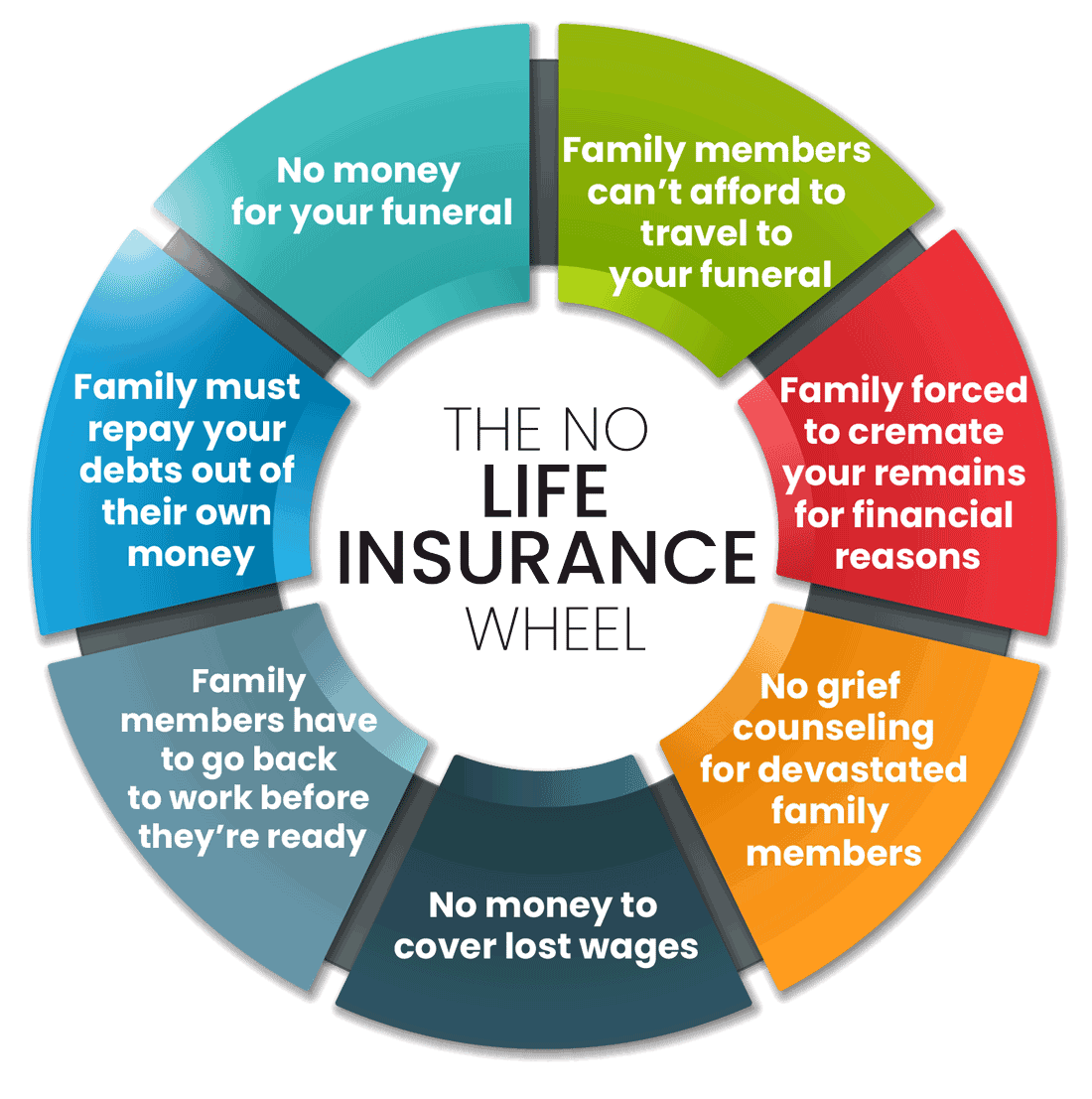

The Financial Risks of Not Having Life Insurance

To understand how term life insurance can save you money, it’s important to consider the potential financial risks of not having adequate coverage:

- Loss of Income: The most obvious risk is the loss of income if the primary breadwinner dies. This can leave a family struggling to pay for basic needs like housing, food, and healthcare.

- Outstanding Debts: Mortgages, car loans, student loans, and credit card debt can become a significant burden for surviving family members.

- Education Expenses: Funding college education for children can be a major financial challenge, especially if the primary income source is gone.

- Funeral Costs: Funeral expenses can be surprisingly high, often costing thousands of dollars.

- Estate Taxes: In some cases, large estates may be subject to estate taxes, which can further deplete assets.

Without life insurance, these financial burdens can derail your family’s financial stability and future prospects.

How Term Life Insurance Saves You Money: The Direct and Indirect Benefits

Now, let’s explore the specific ways in which term life insurance can save you thousands of dollars:

-

Debt Elimination:

- Mortgage Protection: A term life insurance policy can be designed to cover the outstanding balance of your mortgage. If you die during the term, the death benefit can be used to pay off the mortgage, allowing your family to remain in their home without the burden of mortgage payments. This can save them from potential foreclosure and the emotional distress of losing their home.

- Loan Repayment: Similarly, the death benefit can be used to pay off other debts, such as car loans, student loans, and credit card debt. This prevents these debts from becoming a burden on your family’s finances.

-

Income Replacement:

- Living Expenses: A well-structured term life insurance policy can provide income replacement for your family, covering essential living expenses like housing, food, utilities, and transportation. This ensures that your family can maintain their standard of living without struggling to make ends meet.

- Childcare Costs: If you have young children, the death benefit can be used to cover childcare expenses, allowing your spouse to continue working or pursue education without worrying about childcare costs.

-

Education Funding:

- College Savings: The death benefit can be used to fund college education for your children, ensuring that they have the opportunity to pursue higher education without incurring significant debt. This can be a life-changing benefit for your children, opening doors to better career opportunities and financial stability.

-

Funeral Expenses:

- Burial/Cremation Costs: Funeral expenses can be substantial, often costing thousands of dollars. A term life insurance policy can cover these costs, relieving your family of this financial burden during a difficult time.

-

Estate Planning:

- Tax Mitigation: Life insurance can be used as a tool in estate planning to mitigate estate taxes. The death benefit can provide liquidity to pay estate taxes, preventing the forced sale of assets to cover these taxes.

-

Peace of Mind:

- Reduced Stress: Knowing that your family is financially protected in the event of your death can provide significant peace of mind. This can reduce stress and anxiety, allowing you to focus on living your life to the fullest.

- Financial Security: Term life insurance provides a sense of financial security for your family, knowing that they will be able to cope financially in the event of your death.

Comparing Term Life Insurance to Other Options

When considering life insurance, it’s essential to compare term life insurance to other options, such as whole life insurance:

- Term Life Insurance:

- Pros: Lower premiums, simple to understand, provides a large death benefit for a specific term.

- Cons: No cash value, coverage ends at the end of the term, premiums may increase upon renewal.

- Whole Life Insurance:

- Pros: Cash value accumulation, lifelong coverage, premiums remain level.

- Cons: Higher premiums, complex structure, lower death benefit for the same premium amount.

For most people, term life insurance is the most cost-effective way to obtain adequate coverage. The lower premiums allow you to purchase a larger death benefit, providing greater financial protection for your family. The cash value accumulation of whole life insurance may seem appealing, but the returns are often lower than other investment options.

Factors Affecting Term Life Insurance Costs

Several factors can affect the cost of term life insurance premiums:

- Age: The younger you are, the lower the premiums will be.

- Health: Your health status plays a significant role in determining premiums. Healthier individuals typically pay lower premiums.

- Gender: Women generally pay lower premiums than men due to their longer life expectancy.

- Coverage Amount: The larger the death benefit, the higher the premiums.

- Term Length: Longer terms typically have higher premiums.

- Lifestyle: Risky behaviors like smoking or engaging in hazardous activities can increase premiums.

Tips for Saving on Term Life Insurance

Here are some tips for saving money on term life insurance:

- Buy Early: Purchase coverage when you are young and healthy to secure lower premiums.

- Shop Around: Compare quotes from multiple insurance companies to find the best rates.

- Improve Your Health: Maintain a healthy lifestyle by exercising regularly, eating a balanced diet, and avoiding smoking.

- Choose the Right Term Length: Select a term length that matches your financial needs and obligations.

- Consider a Medical Exam: Undergoing a medical exam can sometimes lower your premiums, especially if you are in good health.

- Work with an Independent Agent: An independent insurance agent can help you compare quotes from multiple companies and find the best coverage for your needs.

Conclusion

Term life insurance is a valuable financial tool that can save you thousands of dollars by protecting your family from potential financial disasters. By providing debt elimination, income replacement, education funding, and peace of mind, term life insurance ensures that your loved ones are financially secure in the event of your death. While the idea of paying premiums may seem like an expense, the potential financial benefits far outweigh the costs. By purchasing term life insurance, you are investing in your family’s future and providing them with a safety net that can help them navigate life’s challenges.