Permanent Life Insurance: A Comprehensive Look at the Pros and Cons

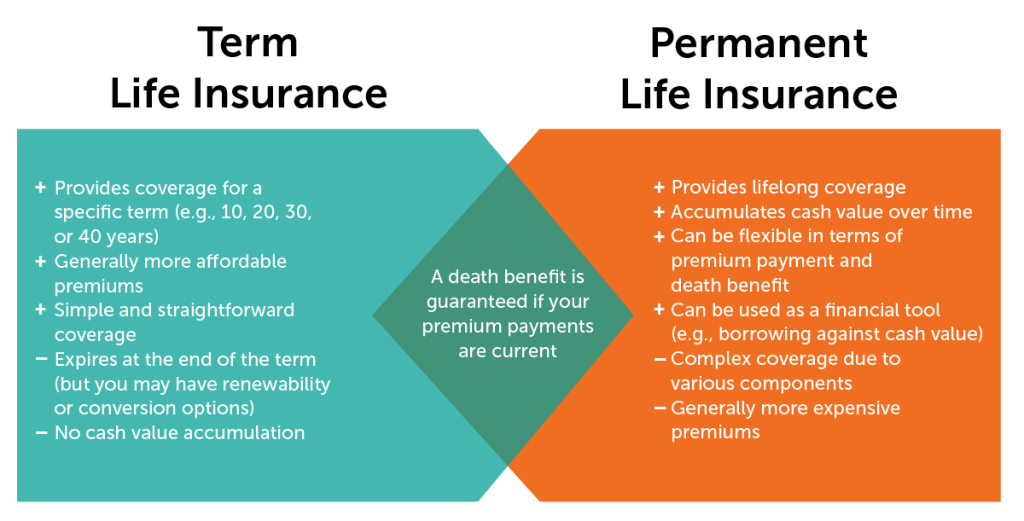

Life insurance is a cornerstone of financial planning, providing a safety net for loved ones in the event of an unexpected passing. While term life insurance offers coverage for a specific period, permanent life insurance provides lifelong protection, along with a cash value component. This article delves into the advantages and disadvantages of permanent life insurance, helping you make an informed decision about whether it aligns with your financial goals and needs.

Understanding Permanent Life Insurance

Permanent life insurance is a type of life insurance policy that remains in effect for the insured’s entire life, provided premiums are paid. Unlike term life insurance, which expires after a set term (e.g., 10, 20, or 30 years), permanent life insurance offers lifelong coverage.

The key feature that distinguishes permanent life insurance is its cash value component. A portion of each premium payment is allocated to a cash value account, which grows over time on a tax-deferred basis. Policyholders can access this cash value through withdrawals or loans, offering a source of funds for various financial needs.

There are several types of permanent life insurance, each with its own characteristics:

-

Whole Life Insurance: Offers a fixed premium, a guaranteed death benefit, and a guaranteed rate of return on the cash value.

Universal Life Insurance: Provides more flexibility than whole life insurance, allowing policyholders to adjust premium payments and death benefit amounts within certain limits. The cash value growth is tied to current interest rates.

-

Variable Life Insurance: Combines life insurance coverage with investment options. The cash value is invested in sub-accounts similar to mutual funds, offering the potential for higher returns but also carrying investment risk.

-

Variable Universal Life Insurance: Combines the flexibility of universal life insurance with the investment options of variable life insurance.

Pros of Permanent Life Insurance

-

Lifelong Coverage: The most significant advantage of permanent life insurance is that it provides coverage for your entire life. As long as premiums are paid, the policy will remain in effect, ensuring that your beneficiaries receive a death benefit regardless of when you pass away. This is particularly valuable for individuals who want to provide long-term financial security for their loved ones.

-

Cash Value Accumulation: The cash value component of permanent life insurance is a valuable asset that grows over time on a tax-deferred basis. This cash value can be accessed through withdrawals or loans, providing a source of funds for various financial needs, such as:

- Emergency Expenses: Unexpected medical bills, home repairs, or job loss.

- Education Funding: College tuition for children or grandchildren.

- Retirement Income: Supplementing retirement savings.

- Business Opportunities: Funding a new business venture.

- Down Payment on a Home: Assisting with a home purchase.

-

Tax Advantages: Permanent life insurance offers several tax advantages:

- Tax-Deferred Growth: The cash value grows on a tax-deferred basis, meaning you don’t have to pay taxes on the earnings until you withdraw them.

- Tax-Free Death Benefit: The death benefit is generally income tax-free for the beneficiaries.

- Tax-Free Loans: Policy loans are generally tax-free, as long as the policy remains in force and the loans are repaid.

-

Estate Planning Benefits: Permanent life insurance can play a crucial role in estate planning. It can be used to:

- Pay Estate Taxes: Provide funds to cover estate taxes, preventing the need to sell assets to pay the tax bill.

- Equalize Inheritance: Ensure that all heirs receive an equal share of the estate, even if some assets are not easily divisible.

- Provide Liquidity: Provide liquidity to the estate, allowing for the payment of debts, expenses, and taxes without having to liquidate other assets.

- Charitable Giving: Make a significant charitable contribution upon death.

-

Loan Availability: Policy loans are relatively easy to obtain, as they don’t require credit checks or extensive paperwork. The interest rates on policy loans are often lower than those on other types of loans.

-

Guaranteed Death Benefit (Whole Life): Whole life insurance provides a guaranteed death benefit, ensuring that your beneficiaries will receive a specific amount of money upon your passing. This can provide peace of mind knowing that your loved ones will be financially secure.

-

Guaranteed Rate of Return (Whole Life): Whole life insurance offers a guaranteed rate of return on the cash value, providing a predictable and stable investment option.

Cons of Permanent Life Insurance

-

Higher Premiums: Permanent life insurance policies typically have significantly higher premiums than term life insurance policies. This is because permanent life insurance provides lifelong coverage and includes a cash value component, which requires higher premium payments.

-

Complexity: Permanent life insurance policies can be complex and difficult to understand, especially variable and universal life insurance. It’s essential to work with a knowledgeable financial advisor to fully understand the policy’s features, benefits, and risks.

-

Fees and Expenses: Permanent life insurance policies often come with various fees and expenses, such as:

- Mortality Charges: Cover the cost of insurance.

- Administrative Fees: Cover the cost of administering the policy.

- Surrender Charges: Fees charged if you cancel the policy within a certain period.

- Investment Management Fees (Variable Life): Fees charged for managing the investment sub-accounts.

-

Lower Initial Death Benefit: Due to the higher premiums and cash value component, the initial death benefit of a permanent life insurance policy may be lower than that of a term life insurance policy with comparable premiums.

-

Cash Value Growth May Be Slower Than Other Investments: The cash value growth in a permanent life insurance policy may be slower than that of other investment options, such as stocks, bonds, or mutual funds.

-

Policy Loans Can Reduce Death Benefit: If you take out a policy loan and don’t repay it, the outstanding loan balance will be deducted from the death benefit, reducing the amount your beneficiaries receive.

-

Surrender Charges Can Be Significant: If you cancel your permanent life insurance policy within the first few years, you may have to pay significant surrender charges, which can reduce the amount of cash value you receive.

-

Risk of Policy Lapse: If you stop paying premiums on a permanent life insurance policy, the policy will lapse, and you will lose the coverage and the cash value.

Who Should Consider Permanent Life Insurance?

Permanent life insurance may be a suitable option for individuals who:

- Need Lifelong Coverage: Want to ensure that their beneficiaries receive a death benefit regardless of when they pass away.

- Want to Accumulate Cash Value: Are looking for a tax-advantaged way to save for future financial needs.

- Have Estate Planning Needs: Need to provide funds to cover estate taxes or equalize inheritance.

- Are High-Net-Worth Individuals: May benefit from the tax advantages and estate planning benefits of permanent life insurance.

- Want a Guaranteed Death Benefit and Rate of Return: Prefer the stability and predictability of whole life insurance.

Who Should Consider Term Life Insurance Instead?

Term life insurance may be a better option for individuals who:

- Need Coverage for a Specific Period: Only need coverage for a specific period, such as to cover a mortgage or child-rearing expenses.

- Are on a Tight Budget: Want to obtain the most coverage for the lowest possible premium.

- Are Comfortable Investing on Their Own: Prefer to invest the difference in premiums between term and permanent life insurance in other investments.

Making the Right Decision

Deciding whether to purchase permanent life insurance is a complex decision that requires careful consideration of your financial goals, needs, and risk tolerance. It’s essential to:

- Assess Your Needs: Determine how much coverage you need and for how long.

- Compare Policies: Compare different types of permanent life insurance policies and their features, benefits, and costs.

- Understand the Fees and Expenses: Carefully review the fees and expenses associated with the policy.

- Consider Your Investment Options: Evaluate whether the cash value growth in the policy is likely to meet your investment goals.

- Consult a Financial Advisor: Work with a qualified financial advisor to get personalized advice and guidance.

Conclusion

Permanent life insurance offers lifelong coverage, cash value accumulation, tax advantages, and estate planning benefits. However, it also comes with higher premiums, complexity, and fees. By carefully weighing the pros and cons and consulting with a financial advisor, you can make an informed decision about whether permanent life insurance is the right choice for you.