Life Insurance for Smokers: Companies with the Best Rates

Smoking significantly impacts health, leading to higher risks of various diseases, including lung cancer, heart disease, and respiratory problems. Consequently, life insurance companies consider smokers as high-risk applicants. This higher risk translates into substantially higher premiums compared to non-smokers. However, finding affordable life insurance as a smoker is not impossible. By understanding the factors that affect rates and knowing where to look, smokers can secure the coverage they need at a reasonable price.

Why Smoking Affects Life Insurance Rates

Life insurance is based on risk assessment. Insurers evaluate the likelihood of paying out a death benefit during the policy term. Since smoking increases the risk of premature death due to various health complications, insurers charge smokers higher premiums to offset this increased risk.

The higher rates for smokers reflect the statistical reality that smokers, on average, have a shorter life expectancy and are more prone to life-threatening illnesses. Insurers use actuarial data to quantify these risks and adjust premiums accordingly.

Factors Influencing Life Insurance Rates for Smokers

Several factors influence the life insurance rates offered to smokers:

-

Type of Tobacco Use:

- Cigarettes: Cigarette smoking is generally considered the riskiest form of tobacco use due to the high levels of harmful chemicals and the direct link to lung cancer. As a result, cigarette smokers often face the highest premiums.

- Cigars and Pipes: While still risky, cigars and pipes may sometimes be viewed slightly more favorably than cigarettes, especially if they are not used daily. However, daily cigar or pipe smoking can still result in high premiums.

- Smokeless Tobacco: Smokeless tobacco products like chewing tobacco and snuff also increase health risks, although some insurers may view them as less risky than cigarettes.

- E-Cigarettes and Vaping: The perception of e-cigarettes and vaping is evolving. Some insurers treat vapers the same as cigarette smokers due to the potential health risks associated with nicotine and other chemicals in vaping products. Others may offer slightly better rates, especially if the applicant has switched from traditional cigarettes to vaping.

-

Frequency of Smoking:

- Daily vs. Occasional: The more frequently you smoke, the higher the risk, and consequently, the higher the premium. Daily smokers will typically face much higher rates than those who smoke occasionally.

- Quantity: The number of cigarettes, cigars, or bowls of tobacco smoked per day also affects rates. Heavier smokers are considered higher risk than light smokers.

-

Age:

- Younger Smokers: Younger smokers generally pay lower premiums than older smokers because they have a longer potential lifespan ahead of them. However, the difference in rates between smokers and non-smokers is still significant, regardless of age.

- Older Smokers: Older smokers face the highest premiums due to the cumulative effect of smoking on their health over many years.

-

Health Conditions:

- Pre-Existing Conditions: Any pre-existing health conditions, such as heart disease, respiratory problems, or diabetes, will further increase the cost of life insurance for smokers.

- Family History: A family history of smoking-related illnesses can also impact rates, as it suggests a genetic predisposition to these conditions.

-

Type of Life Insurance Policy:

- Term Life Insurance: Term life insurance provides coverage for a specific period (e.g., 10, 20, or 30 years). It is generally more affordable than whole life insurance, especially for smokers.

- Whole Life Insurance: Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. It is typically more expensive than term life insurance, and the premiums for smokers can be very high.

- Guaranteed Acceptance Life Insurance: Guaranteed acceptance life insurance does not require a medical exam or health questionnaire. While it provides coverage to almost anyone, including smokers with severe health issues, it comes with high premiums and limited coverage amounts.

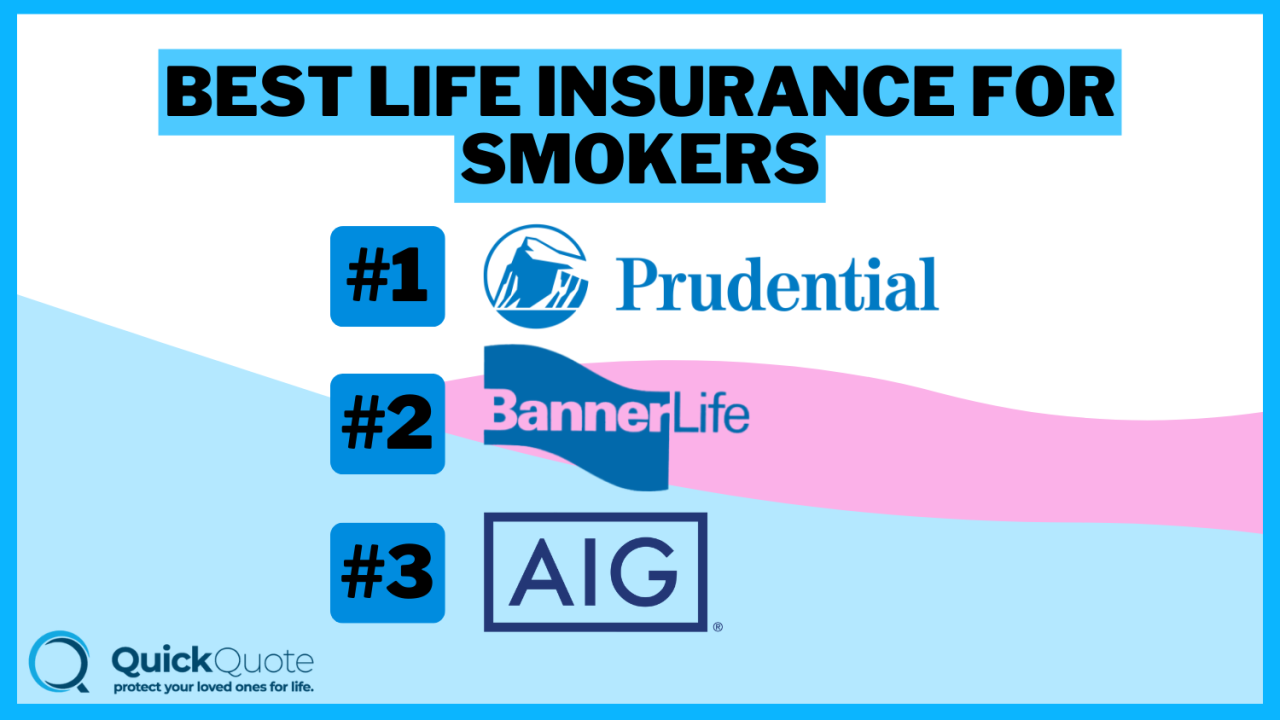

Companies with the Best Rates for Smokers

While no life insurance company specifically caters to smokers, some companies offer more competitive rates than others. Here are some insurers known for being relatively more lenient towards smokers:

-

Prudential: Prudential is often cited as one of the more smoker-friendly life insurance companies. They tend to be more lenient with occasional smokers and may offer slightly better rates than some competitors.

-

Protective Life: Protective Life is known for offering competitive rates to a wide range of applicants, including those with certain health conditions. Smokers may find their rates to be more reasonable compared to other insurers.

-

Transamerica: Transamerica offers a variety of life insurance products and may be more accommodating to smokers, particularly those who are in relatively good health otherwise.

-

Banner Life: Banner Life is another company that may offer competitive rates for smokers, especially for term life insurance policies.

-

Lincoln Financial: Lincoln Financial is known for its flexible underwriting and may be willing to consider individual circumstances when assessing risk, potentially leading to more favorable rates for some smokers.

Tips for Finding Affordable Life Insurance as a Smoker

Finding affordable life insurance as a smoker requires careful planning and comparison shopping. Here are some tips to help you secure the best possible rates:

-

Quit Smoking: The most effective way to lower your life insurance premiums is to quit smoking. After a certain period of being tobacco-free (typically 12 months or more), you may qualify for non-smoker rates. This can result in significant savings over the life of the policy.

-

Shop Around: Don’t settle for the first quote you receive. Get quotes from multiple life insurance companies to compare rates and coverage options. Use online quote comparison tools or work with an independent insurance agent who can shop around on your behalf.

-

Be Honest: Always be honest about your smoking habits when applying for life insurance. Providing false information can lead to the denial of coverage or the cancellation of your policy.

-

Consider Term Life Insurance: Term life insurance is generally more affordable than whole life insurance, especially for smokers. If you only need coverage for a specific period, a term life policy can be a cost-effective option.

-

Improve Your Health: While smoking is a major factor, your overall health also plays a role in determining your life insurance rates. Maintaining a healthy weight, exercising regularly, and managing any existing health conditions can help improve your chances of getting a better rate.

-

Work with an Independent Agent: An independent insurance agent can help you navigate the complex world of life insurance and find the best policy for your needs and budget. They can provide personalized advice and shop around with multiple companies to find the most competitive rates.

-

Explore "Preferred Smoker" Rates: Some insurance companies offer "preferred smoker" rates to smokers who are in excellent health otherwise. If you are a smoker but have no other significant health issues, you may qualify for these lower rates.

-

Consider a Medical Exam: While some policies don’t require a medical exam, opting for one can sometimes result in lower rates. A medical exam provides the insurer with a more accurate assessment of your health, which can be beneficial if you are in relatively good health despite being a smoker.

-

Re-evaluate Your Coverage Needs: Determine how much coverage you actually need. Avoid purchasing more coverage than necessary, as this will only increase your premiums.

-

Check Group Life Insurance Options: If your employer offers group life insurance, consider enrolling in the plan. Group life insurance often has more lenient underwriting requirements and may be more affordable than individual policies.

The Impact of Quitting Smoking on Life Insurance Rates

Quitting smoking is the single most effective way to lower your life insurance premiums. Most insurance companies require you to be tobacco-free for at least 12 months to qualify for non-smoker rates. Some companies may require a longer period, such as 24 or 36 months.

Once you have quit smoking and met the required waiting period, you can apply for a new life insurance policy as a non-smoker. You may also be able to have your existing policy re-evaluated to reflect your non-smoker status.

The savings from switching from smoker to non-smoker rates can be substantial. Over the life of a policy, you could save thousands of dollars in premiums.

Conclusion

Finding affordable life insurance as a smoker can be challenging, but it is not impossible. By understanding the factors that affect rates, shopping around, and making healthy lifestyle choices, smokers can secure the coverage they need at a reasonable price. Quitting smoking is the most effective way to lower premiums, but even if you continue to smoke, there are steps you can take to find more competitive rates. Working with an independent agent and comparing quotes from multiple companies can help you find the best policy for your individual circumstances.