Introduction

Finding the right life insurance policy can be a daunting task, but the process doesn’t have to be overly complicated. Many companies now offer online applications designed for speed and simplicity. Understanding what constitutes an “easy” application and approval process is crucial for consumers seeking efficient and stress-free life insurance coverage. This section clarifies the criteria consumers often prioritize and the factors influencing a quick approval.

Consumers generally define an “easy” online life insurance application process based on several key factors. Primarily, ease of use and a streamlined workflow are paramount. This means intuitive navigation, clear instructions, and a straightforward application form that avoids unnecessary jargon or complex questions. A quick turnaround time for application processing and approval is also a major consideration, minimizing the waiting period before coverage begins. Transparency throughout the process, including clear communication about required documents and the status of the application, further contributes to a positive user experience.

Factors Contributing to Swift Approval

Several factors significantly influence the speed of the life insurance approval process. Firstly, the applicant’s health status plays a critical role. Applicants with excellent health typically experience faster approvals than those with pre-existing conditions requiring further medical review. The completeness and accuracy of the application are also crucial. Providing all necessary information and documentation accurately reduces delays caused by information requests or corrections. Finally, the insurer’s internal processing efficiency, including streamlined underwriting procedures and efficient communication channels, impacts the overall speed of approval. For example, an insurer with a fully digitalized system can process applications and supporting documents much faster than one relying on manual processes.

Features Simplifying the Application Process

Modern online life insurance applications incorporate several features designed to simplify the process. Online forms allow applicants to complete the application conveniently at any time, eliminating the need for paperwork and postal mail. Digital document upload capabilities allow applicants to submit supporting documents, such as medical records or driver’s licenses, electronically, further streamlining the process. Instantaneous quotes provide applicants with immediate feedback on potential premiums, helping them compare options and make informed decisions. Real-time application status tracking allows applicants to monitor the progress of their application and receive updates on any required actions, promoting transparency and reducing anxiety. Automated systems, using AI and machine learning, can efficiently process applications, flagging potential issues and speeding up the review process. For instance, some insurers use AI to analyze medical information and identify potential risk factors more quickly, accelerating the underwriting decision.

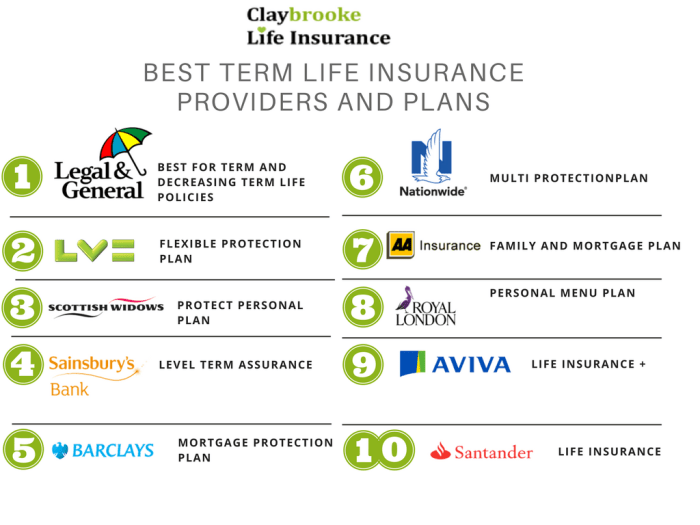

Top Companies

Choosing the right online life insurance provider can significantly impact your application experience. Factors like ease of use, speed of approval, and the comprehensiveness of coverage offered vary widely between companies. Understanding these differences is crucial for a smooth and efficient process.

Several companies stand out for their user-friendly online platforms and streamlined application processes. The following table highlights key features of some leading providers, allowing for a direct comparison.

Leading Online Life Insurance Providers

| Company Name | Application Process Description | Approval Timeframe | Notable Features |

|---|---|---|---|

| Term Life Insurance | Simple online application with a health questionnaire; requires minimal documentation. | Often within 24 hours for instant decisions, or a few days for full underwriting. | Wide range of coverage options, competitive pricing, and easy-to-understand policies. |

| Bestow | Fully digital application; uses AI-powered underwriting for faster decisions. | Often provides instant approval decisions for eligible applicants. | Focus on speed and convenience, transparent pricing, and minimal paperwork. |

| Fabric | Digital application process with integration of financial planning tools. | Approval times vary depending on individual health and financial factors, but generally aims for efficiency. | Combines life insurance with financial planning features, providing a holistic approach. |

| Haven Life | User-friendly online application with a clear, step-by-step process. | Approval times vary, but the company emphasizes a relatively quick turnaround. | Backed by MassMutual, providing financial strength and stability. |

| Ladder | Simple online application with adjustable coverage amounts and term lengths. | Offers instant decisions for some applicants, while others may require further underwriting. | Known for its flexibility and ability to easily adjust coverage as needed. |

Comparison of Application Processes

Comparing Bestow, Term Life Insurance, and Ladder reveals interesting contrasts in their approaches. Bestow prioritizes speed through its AI-driven underwriting, often providing instant approvals. This contrasts with Term Life Insurance, which while also efficient, may require a few days for complete processing depending on the applicant’s profile. Ladder occupies a middle ground, offering instant decisions for some but utilizing traditional underwriting for others, providing flexibility. The choice depends on individual priorities – speed versus a more comprehensive review.

Unique Selling Propositions of Streamlined Providers

Two companies exemplify straightforward application procedures with distinct selling points. Bestow’s unique selling proposition is its speed and ease. The AI-powered underwriting system minimizes paperwork and provides instant decisions for many applicants, catering to those seeking a quick and hassle-free experience. This resonates strongly with time-conscious individuals. In contrast, Term Life Insurance focuses on a user-friendly interface and transparent pricing, making the process easily navigable for individuals who might lack prior experience with life insurance. This accessibility broadens its appeal to a wider audience.

Application Process Deep Dive

Applying for life insurance online can seem daunting, but understanding the typical process can alleviate anxieties. This section provides a step-by-step analysis, highlighting potential challenges and offering guidance for a smoother experience. The goal is to demystify the application process and empower you to make informed decisions.

The online application process for life insurance generally follows a standardized sequence, although specifics may vary slightly between insurers. However, the core steps remain consistent, ensuring a relatively uniform experience across different providers.

Typical Online Life Insurance Application Steps

The following bullet points Artikel a typical online application flow, from initial inquiry to final approval. Understanding these steps can help you prepare necessary documents and anticipate potential delays.

- Initial Information Gathering: This involves providing basic details such as age, gender, smoking status, and desired coverage amount. Many companies offer instant quotes at this stage based on this preliminary information.

- Health Questionnaire: This is a crucial step where you’ll answer questions about your medical history, current health conditions, and family medical history. Accuracy is paramount here, as inaccurate information can lead to delays or rejection.

- Medical Examinations (Sometimes Required): Depending on the coverage amount and your health profile, some insurers may require a medical exam conducted by a physician or a paramedical professional. This typically involves blood and urine tests and a physical examination.

- Policy Review and Selection: Once the insurer has reviewed your application and any required medical information, they’ll present you with available policy options tailored to your needs and risk profile. You can compare options and choose the best fit.

- Payment and Policy Issuance: After selecting a policy, you’ll need to provide payment information. Once the payment is processed, the policy documents will be issued, usually electronically.

Potential Application Roadblocks

While the online application process is designed for convenience, several factors can cause delays or rejection. Understanding these potential hurdles can help you proactively address them.

- Inaccurate or Incomplete Information: Providing false or misleading information, even unintentionally, can lead to application rejection. Double-check all information before submission.

- Pre-existing Medical Conditions: Individuals with pre-existing conditions might face higher premiums or even application denial, depending on the severity and nature of the condition. Being upfront about your health history is crucial.

- Difficulties with Medical Examinations: Scheduling and completing medical exams can sometimes be challenging, particularly for individuals with busy schedules or limited mobility. Plan ahead and communicate with the insurer if you encounter scheduling difficulties.

- Technical Issues: Website glitches or application errors can disrupt the process. If you encounter technical problems, contact the insurer’s customer support for assistance.

- Insufficient Income or Credit Score (for certain policies): Some life insurance policies might require a minimum income or credit score to be approved. Applicants not meeting these requirements may face rejection or be offered limited options.

Simplified Application Process Flowchart

The following textual representation depicts a simplified flowchart of the online life insurance application process. Imagine a visual flowchart where each step flows from top to bottom, with decision points indicated by diamonds and processes by rectangles.

Start -> Provide Basic Information -> Complete Health Questionnaire -> Medical Exam (If Required) -> Policy Review and Selection -> Payment -> Policy Issuance -> End

Factors Influencing Approval

Securing life insurance involves a thorough application process where insurers assess various factors to determine eligibility and premiums. Understanding these factors can significantly improve your chances of a smooth and quick approval. This section details the key elements influencing your application’s outcome.

Applicant Health History

Your health history plays a pivotal role in the underwriting process. Insurers carefully review medical records, including pre-existing conditions, hospitalizations, surgeries, and current medications. The severity and nature of any health issues directly impact your eligibility and the premiums you’ll pay. For instance, applicants with a history of heart disease or cancer may face higher premiums or even be denied coverage depending on the severity and stage of the condition. Conversely, individuals with a clean bill of health and a healthy lifestyle can expect a faster approval process and potentially lower premiums. The insurer’s assessment considers not only the presence of a condition but also its stability and prognosis. Regular check-ups and proactive health management can positively influence the underwriting decision.

Financial Information

Financial stability is another crucial factor. Insurers examine your income, assets, and debts to assess your ability to maintain premium payments. Providing accurate and comprehensive financial information is essential. Income documentation, such as pay stubs or tax returns, is often required. Similarly, details about assets like savings accounts, investments, and property ownership can strengthen your application. High levels of debt relative to income may raise concerns about your ability to consistently pay premiums, potentially leading to a higher premium or denial of coverage. A strong financial profile demonstrates your capacity to meet your financial obligations, improving your chances of approval.

Lifestyle and Habits

Beyond health and finances, lifestyle factors significantly influence the approval process. Insurers often inquire about smoking, alcohol consumption, and other risky behaviors. Applicants who engage in high-risk activities, such as extreme sports, may face higher premiums or be deemed ineligible for certain types of coverage. A healthy lifestyle, including regular exercise and a balanced diet, can demonstrate a lower risk profile and contribute to a more favorable outcome. Openly and honestly disclosing all relevant information is crucial for a fair and accurate assessment. Misrepresentation can lead to delays or denial of coverage.

Policy Types and Their Application Procedures

Understanding the differences between term and whole life insurance is crucial for navigating the application process. Both types offer death benefit protection, but their structures, costs, and application procedures vary significantly. Choosing the right policy depends heavily on individual financial goals and risk tolerance.

The application process for both term and whole life insurance generally involves a similar initial stage: providing personal information, health history, and beneficiary details. However, the subsequent steps and the level of scrutiny differ considerably, largely due to the fundamental differences in the policies themselves.

Term Life Insurance Application Process

Term life insurance offers coverage for a specified period (term), typically ranging from 10 to 30 years. The application process for term life insurance is usually straightforward and faster than for whole life insurance. Insurers prioritize speed and efficiency to cater to a wider market segment seeking affordable, temporary coverage.

Applicants are typically asked about their health history, lifestyle habits (smoking, alcohol consumption), and occupation. The underwriting process often involves a medical exam for higher coverage amounts, but for smaller amounts, it may only require answering health questionnaires.

Examples of common questions asked during a term life insurance application include:

- Current age and date of birth

- Height and weight

- Smoking status

- Medical history, including any pre-existing conditions and hospitalizations

- Family medical history

- Occupation and hobbies

- Beneficiary information

Whole Life Insurance Application Process

Whole life insurance provides lifelong coverage, offering a death benefit payable upon the insured’s death, regardless of when it occurs. Because of the lifelong commitment and the cash value component, the application process for whole life insurance is generally more rigorous and time-consuming. Underwriting is more thorough, requiring more detailed information and often involving a comprehensive medical examination.

The insurer’s assessment goes beyond simple health questions; they will meticulously examine the applicant’s financial stability and overall risk profile. This is because whole life insurance policies are long-term financial instruments with significant financial implications for the insurer.

Examples of questions commonly asked during a whole life insurance application include:

- All questions asked in a term life application

- Detailed financial information, including income, assets, and debts

- Information about any existing life insurance policies

- Reasons for seeking whole life insurance

- Planned use of the policy’s cash value component

Comparison of Required Documentation and Underwriting

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Application Form | Standard form, relatively short | More comprehensive form, often requiring detailed financial information |

| Medical Examination | Often required for higher coverage amounts, may be waived for smaller amounts | Usually required, regardless of coverage amount |

| Underwriting Process | Generally faster and less stringent | More thorough and time-consuming |

| Documentation | Basic personal and health information | Extensive personal, health, and financial information |

Customer Reviews and Testimonials

Understanding customer experiences is crucial for assessing the true ease of application and approval processes offered by online life insurance companies. Analyzing reviews and testimonials provides valuable insights into the practical aspects of using these services, beyond the marketing claims. By examining both positive and negative feedback, we can identify areas of excellence and areas needing improvement in the customer journey.

Customer reviews offer a rich source of unfiltered feedback, revealing the nuances of the application and approval process that may not be apparent from company marketing materials. They provide a realistic perspective on the overall customer experience, allowing for a more informed comparison between different providers.

Summary of Customer Reviews on Ease of Application and Approval

Analyzing numerous customer reviews across various online platforms reveals recurring themes regarding the ease of application and approval processes. These reviews highlight both positive and negative aspects of the experience, offering a balanced perspective.

- Positive Feedback: Many reviewers praise the user-friendly online platforms, the clear and concise application forms, and the quick response times from customer service representatives. Several mentioned the streamlined process and the efficient communication throughout the application and approval stages. Examples include comments such as “The application was incredibly easy to complete, and I received approval within days,” and “The website was intuitive and easy to navigate, making the whole process stress-free.”

- Negative Feedback: Conversely, some reviews criticize complex application forms, lengthy processing times, and difficulties contacting customer support. Some reviewers experienced technical glitches on the company websites, leading to frustration and delays. Examples of negative comments include: “The application was confusing and required too much information,” and “I waited weeks for an approval decision, and customer service was unhelpful.”

Common Positive and Negative Feedback Themes

The analysis of customer reviews reveals several overarching themes that consistently appear in both positive and negative feedback. These themes directly impact a company’s reputation for providing a streamlined application and approval process.

- Positive Themes: User-friendly interfaces, clear instructions, fast processing times, responsive customer service, and transparent communication are recurring themes in positive reviews. These factors contribute to a positive customer experience and enhance the company’s reputation for efficiency.

- Negative Themes: Conversely, confusing interfaces, complicated forms, slow processing times, unresponsive customer service, and lack of transparency are common themes in negative reviews. These factors can significantly damage a company’s reputation and deter potential customers.

Impact of Customer Experience on Company Reputation

The customer experience directly influences a company’s reputation for streamlined processes. Positive reviews highlighting ease of use and quick approvals attract new customers and build trust. Conversely, negative reviews describing difficult applications and lengthy wait times can deter potential clients and damage the company’s brand image. Online reviews are readily accessible and significantly influence consumer decisions. A strong reputation for a smooth and efficient application process is a key competitive advantage in the online life insurance market.

Tips for a Smooth Application

Securing life insurance efficiently hinges on a well-prepared application. By following best practices and providing accurate information, applicants can significantly reduce processing time and increase their chances of approval. This section Artikels key strategies to navigate the application process smoothly.

Accurate and complete information is paramount throughout the application. Inaccuracies, omissions, or inconsistencies can lead to delays, requests for further information, or even application rejection. The insurer needs a comprehensive picture of your health and financial situation to assess risk accurately. Providing false information is unethical and can have serious consequences.

Importance of Accurate Information

Providing truthful and complete information is crucial for a swift and successful application. Any discrepancies discovered during the underwriting process can delay the approval, sometimes significantly. For instance, omitting a pre-existing medical condition could lead to a policy being denied or having higher premiums applied retroactively if discovered later. Similarly, inaccurate income information can impact the policy amount you qualify for. Therefore, double-checking all details before submission is vital. This includes reviewing all sections of the application form, ensuring consistency between provided documents and the application data, and verifying all contact information.

Addressing Potential Issues or Delays

Proactive steps can mitigate potential application delays. For example, if you anticipate a question about your medical history, gather relevant medical records beforehand to readily provide them to the insurer. This shows preparedness and cooperation, streamlining the verification process. If you experience a delay, contacting the insurer directly to inquire about the status of your application is advisable. This proactive approach can help resolve any outstanding issues quickly. Remember to keep records of all communications with the insurance company.

Steps to Expedite the Application Process

Several steps can help expedite the application process. First, gather all necessary documentation before starting the application. This includes identification documents, medical records (if required), and financial information. Secondly, complete the application thoroughly and accurately, double-checking all entries for errors. Thirdly, respond promptly to any requests for additional information from the insurer. Finally, consider using an online application portal, as these often offer faster processing times compared to paper applications. For example, many insurers offer streamlined digital applications that allow for immediate uploads of supporting documents and real-time status updates.