Introduction

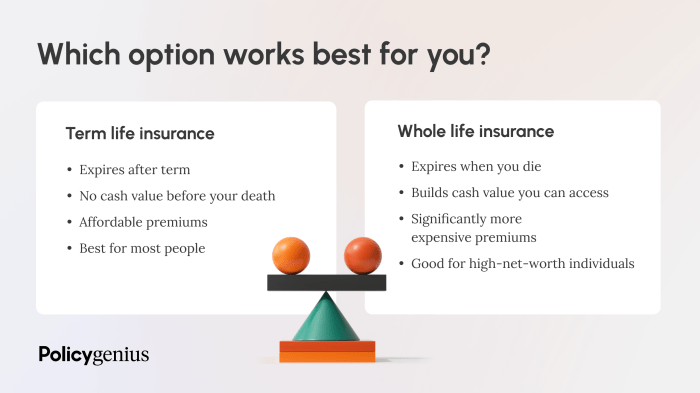

Choosing between term and whole life insurance is a crucial financial decision. Understanding the core differences between these two types of policies is essential for selecting the coverage that best aligns with your individual needs and financial goals. This section will define each type of insurance, compare their key features, and highlight the circumstances where each might be the more suitable option.

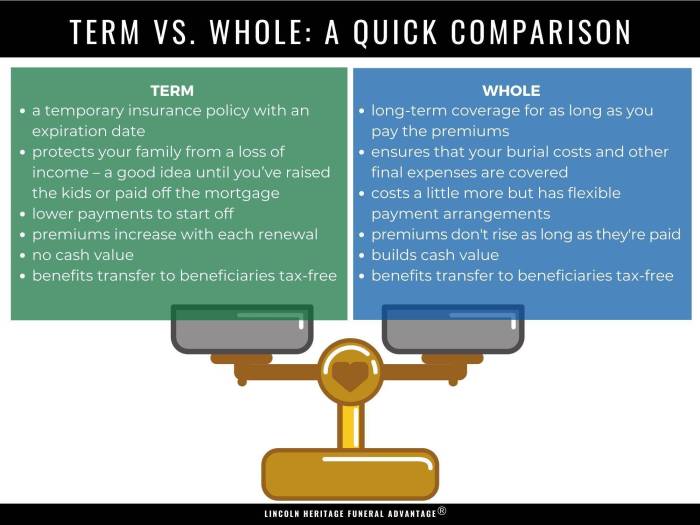

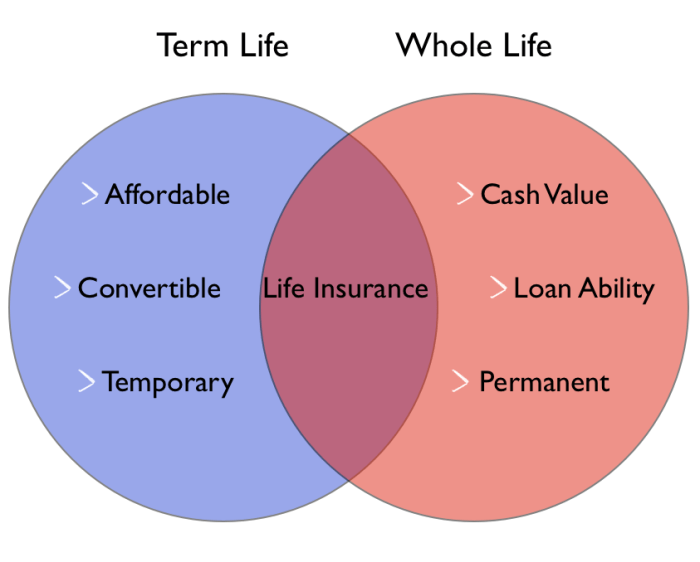

Term life insurance and whole life insurance are fundamentally different products offering distinct benefits and drawbacks. Both provide a death benefit, a payout to your beneficiaries upon your death, but they differ significantly in their structure, cost, and the presence or absence of a cash value component.

Term Life Insurance Definition and Features

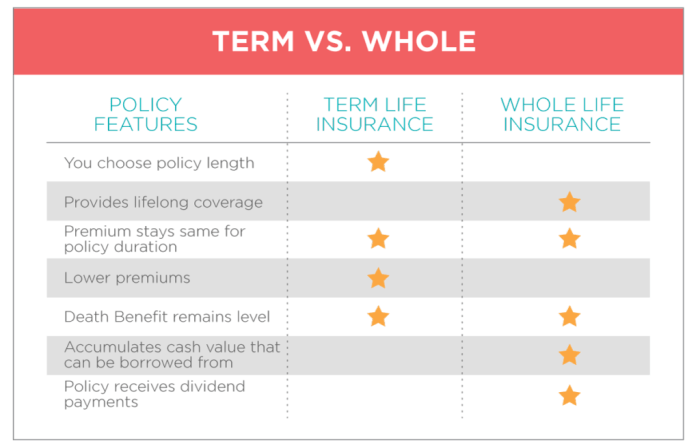

Term life insurance provides coverage for a specified period, or “term,” typically ranging from 10 to 30 years. Premiums remain level during the term, making it a predictable and often more affordable option, especially for younger individuals. However, the coverage expires at the end of the term, unless renewed (often at a higher premium). There is no cash value component; the policy solely provides a death benefit. The affordability and simplicity make it a popular choice for individuals focused on providing financial protection for their families during their working years. For example, a 30-year-old might purchase a 20-year term life insurance policy to cover their mortgage and childcare expenses until their children are grown.

Whole Life Insurance Definition and Features

Whole life insurance, unlike term life insurance, offers lifelong coverage, provided premiums are paid. A key characteristic is its cash value component, which grows tax-deferred over time. This cash value can be borrowed against or withdrawn, though this will reduce the death benefit. Premiums for whole life insurance are generally higher than for term life insurance due to the lifelong coverage and cash value accumulation. This makes it a less affordable option, particularly for those on a tight budget. However, the permanent coverage and cash value component can be attractive to individuals seeking long-term financial security and wealth accumulation. For instance, a business owner might use whole life insurance as part of a long-term estate plan, leveraging the cash value for future business needs or retirement.

Comparison of Term and Whole Life Insurance

The following table summarizes the key differences between term and whole life insurance policies:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Premium Cost | Lower | Higher |

| Death Benefit | Fixed amount for the term | Fixed amount, potentially reduced by cash value withdrawals or loans |

| Cash Value | None | Accumulates tax-deferred |

| Policy Length | Specific term (e.g., 10, 20, 30 years) | Lifelong, provided premiums are paid |

Cost and Premiums

Understanding the cost implications is crucial when choosing between term and whole life insurance. While both offer financial protection for your loved ones, their premium structures and long-term costs differ significantly. This section breaks down the factors influencing premiums for each type and compares their overall financial impact.

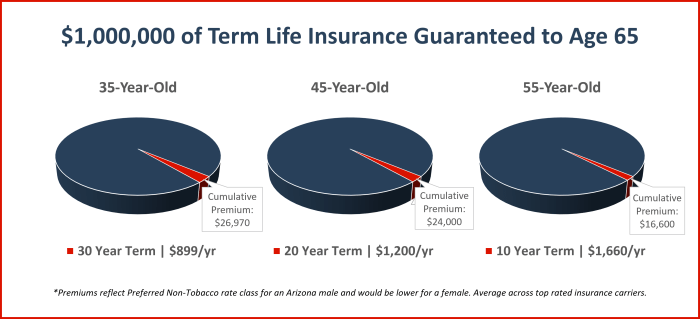

Factors Influencing Term Life Insurance Premiums

Several factors determine the cost of term life insurance premiums. Age is a primary driver; younger applicants generally receive lower rates due to a lower statistical risk of death. Health status also plays a significant role; individuals with pre-existing conditions or unhealthy lifestyles may face higher premiums. The length of the term (e.g., 10-year, 20-year) is another key factor; longer terms typically result in higher premiums per year but may offer lower annual costs overall depending on the length of coverage needed. Finally, the amount of coverage desired directly impacts the premium; a larger death benefit necessitates a higher premium. For example, a 30-year-old healthy male seeking a $500,000, 20-year term policy will likely pay less than a 50-year-old with a history of heart disease seeking the same coverage.

Factors Influencing Whole Life Insurance Premiums

Whole life insurance premiums are influenced by similar factors to term life insurance, including age and health. However, the premium structure differs significantly. Because whole life insurance provides lifelong coverage and builds cash value, premiums are generally much higher than for comparable term life insurance coverage. The cash value accumulation feature itself also influences premiums; the higher the cash value growth rate, the higher the premium. Additionally, the type of whole life policy (e.g., participating vs. non-participating) and the insurer’s specific pricing model influence the premium amount. A younger, healthier individual will still pay less than an older, less healthy individual, but the base cost will always be considerably higher than for term insurance.

Premium Structure Comparison Over the Policy Lifespan

Term life insurance premiums remain level for the duration of the policy term. After the term expires, the policy ends, and coverage ceases unless renewed at a significantly higher rate (reflecting the increased risk associated with higher age). In contrast, whole life insurance premiums remain level for the entire life of the insured, offering lifelong coverage. While whole life premiums are higher initially, they remain consistent, avoiding the need for renewal and subsequent premium increases. The long-term cost of term life insurance may be lower *if* the insured only requires coverage for a specific period, but the cost increases dramatically upon renewal or if coverage is needed beyond the initial term.

Long-Term Cost Implications

The long-term cost implications depend heavily on individual circumstances and needs. For someone needing coverage for a limited time, such as paying off a mortgage or providing for children’s education, term life insurance offers a potentially lower overall cost. However, if lifelong coverage is desired, the cumulative cost of repeatedly renewing term policies may exceed the total cost of a whole life policy. Conversely, if the individual’s needs change and coverage is no longer required, the consistent, lifelong payments for whole life insurance may represent a significant financial burden. Ultimately, a thorough cost-benefit analysis considering individual financial goals and life expectancy is essential.

Death Benefit and Coverage

Understanding the death benefit is crucial when choosing between term and whole life insurance. Both offer a payout upon the insured’s death, but the structure and implications differ significantly. This section will clarify how the death benefit operates in each policy type and compare their payout options.

Term Life Insurance Death Benefit

Term life insurance provides a death benefit only if the insured dies within the specified policy term. The benefit is a fixed amount, paid as a lump sum to the designated beneficiary upon the insured’s death. If the insured outlives the term, the policy expires, and no death benefit is paid. The payout is straightforward and predictable, offering financial protection for a defined period. This simplicity makes it easier to budget for premiums and understand the coverage.

Whole Life Insurance Death Benefit

Whole life insurance, unlike term life, offers a death benefit for as long as the policy remains in force. The death benefit is typically a fixed amount, though some policies may have a slightly increasing benefit. This guaranteed lifelong coverage is a key difference from term insurance. Furthermore, whole life policies often build cash value over time, which can be borrowed against or withdrawn. The death benefit in a whole life policy will generally include the face value of the policy plus any accumulated cash value.

Death Benefit Payout Options

Both term and whole life policies generally offer flexibility in how the death benefit is paid out. Common options include a lump-sum payment, which is the most frequent choice, providing immediate access to the funds. Alternatively, the beneficiary can choose to receive the death benefit in installments over a set period, potentially providing a more manageable stream of income. Some policies may also offer options for structured settlements, where payments are made over a longer period, often adjusted for inflation. The specific payout options available will vary depending on the insurer and the policy details.

Death Benefit Scenario: The Miller Family

Consider the Miller family. John and Mary Miller, both 35, need life insurance to protect their two young children. They have a mortgage and other financial obligations.

John purchases a $500,000 20-year term life insurance policy. If John dies within those 20 years, Mary receives $500,000. However, if he lives past 20 years, the policy expires, and there is no death benefit.

Mary purchases a $500,000 whole life insurance policy. If Mary dies at any point in her life, her beneficiary receives $500,000, plus any accumulated cash value the policy may have built up over the years. This cash value grows tax-deferred and could potentially provide additional funds for the family. If she lives to 100, the death benefit remains in effect. The consistent coverage and potential cash value growth illustrate the core difference between the two policies. The decision hinges on their risk tolerance, financial goals, and long-term planning.

Cash Value and Investment Aspects

Whole life and term life insurance policies differ significantly in their approach to cash value accumulation and investment features. Understanding these differences is crucial for determining which policy aligns best with your financial goals. While term life insurance focuses solely on providing death benefit coverage for a specified period, whole life insurance incorporates a cash value component that grows over time.

Whole life insurance policies build cash value through a portion of your premiums. This cash value grows tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them. The growth rate is typically linked to the insurer’s investment performance, though it’s generally a lower-risk, slower-growing investment compared to the stock market. Policyholders can borrow against this cash value or withdraw it, though this will reduce the death benefit and may impact the policy’s overall value. The cash value component essentially acts as a forced savings plan, providing a potential source of funds for future needs like retirement or education expenses.

Cash Value Accumulation in Whole Life Insurance

The cash value in a whole life policy grows incrementally over the life of the policy. This growth is influenced by several factors, including the premium payments, the policy’s interest rate (often a guaranteed minimum rate plus a potential dividend if the insurer is mutual), and the policy’s fees. A portion of each premium payment goes towards the death benefit, while the remainder contributes to the cash value. The cash value’s growth is not directly tied to market fluctuations, providing a level of stability not found in other investment vehicles. For example, a $100,000 whole life policy might accumulate $20,000 in cash value after 10 years, although this varies significantly based on the policy’s specifics and the insurer’s performance. This accumulation occurs steadily and predictably, offering a sense of financial security over the long term.

Investment Features and Potential Returns of Whole Life Insurance

Whole life insurance policies often include some investment features, although these are generally more conservative than other investment options. The cash value component itself is considered an investment, with returns typically lower than those offered by stocks or mutual funds but with significantly less risk. Some whole life policies offer the option to allocate a portion of the premiums to sub-accounts, allowing for a degree of diversification. However, these sub-accounts are usually subject to fees and may not offer the same high returns as actively managed investment portfolios. The potential returns are generally modest and should be viewed as a long-term, stable growth opportunity rather than a high-yield investment. It’s important to carefully review the policy’s details to understand the specific investment options and associated fees.

Absence of Cash Value in Term Life Insurance

Term life insurance provides a death benefit for a specific period (the term), after which the policy expires. It does not accumulate cash value. The premiums are solely dedicated to paying for the death benefit coverage during the policy’s term. Once the term ends, the policyholder must renew the policy at a higher premium or allow it to lapse. The absence of a cash value component makes term life insurance a more affordable option for those primarily focused on providing death benefit coverage within a specific timeframe, without the need for a savings or investment element.

Tax Implications of Whole Life Insurance Cash Value Growth

The growth of cash value in a whole life insurance policy is tax-deferred, not tax-free. This means that you do not pay taxes on the accumulated interest or earnings until you withdraw the funds. Withdrawals may be subject to income tax on the accumulated earnings portion, and depending on how the funds are accessed, there may be additional tax implications. Loans against the cash value are not taxed, but interest paid on such loans may be tax-deductible in some cases. It is essential to consult with a tax professional to understand the specific tax implications related to your whole life insurance policy and your individual circumstances. For instance, a large withdrawal during retirement could impact your tax bracket.

Policy Length and Renewability

Understanding the duration and renewability options of your life insurance policy is crucial for aligning it with your long-term financial goals and life stage. Both term and whole life insurance offer distinct approaches to coverage length and the ability to extend protection. Choosing the right option depends heavily on your individual needs and financial circumstances.

Term Life Insurance Duration and Renewability

Term life insurance provides coverage for a specified period, or “term,” ranging from one to 30 years. At the end of the term, the policy expires unless renewed. Renewability options vary by insurer and policy, but generally, you can renew a term life insurance policy for another term, although at a higher premium reflecting your increased age and associated higher risk. This renewal is typically guaranteed, meaning the insurer cannot refuse to renew, but the premium will increase. Some term life insurance policies offer a conversion option, allowing you to switch to a permanent policy like whole life insurance without undergoing a new medical exam, although again, at a higher premium.

Whole Life Insurance Duration and Renewability

Whole life insurance, in contrast to term life insurance, provides lifelong coverage as long as premiums are paid. There is no set term; the policy remains in effect until the insured’s death. Whole life policies are not renewed in the same way as term policies. Premiums are typically level, meaning they remain the same throughout the policy’s duration, although some variations exist. However, the policy’s cash value grows over time. While there’s no expiration date, failure to pay premiums will result in the policy lapsing, and coverage will cease.

Policy Duration Flexibility and Limitations

Term life insurance offers flexibility in terms of affordability during a specific period, making it suitable for those needing coverage for a defined time, such as paying off a mortgage or raising children. However, its temporary nature means coverage ends unless renewed, often at a significantly higher cost. Whole life insurance provides the security of lifelong coverage, but this permanence comes at a higher cost and may not be the most efficient use of funds for those only needing coverage for a limited time. The lack of flexibility in adjusting coverage duration in whole life insurance can be a significant limitation for individuals whose needs change substantially over time.

Scenarios for Appropriate Policy Types

The choice between term and whole life insurance hinges on individual circumstances.

- Term Life Insurance: Ideal for individuals needing affordable coverage for a specific period, such as those with a mortgage, young families with significant financial obligations, or those needing temporary coverage until retirement.

- Whole Life Insurance: Most appropriate for individuals who want lifelong coverage, desire a savings component with cash value growth, and can afford the higher premiums. It can also be a suitable option for estate planning purposes or leaving a legacy.

Suitability for Different Life Stages and Needs

Choosing between term and whole life insurance hinges significantly on individual circumstances, financial goals, and risk tolerance. The ideal policy type varies dramatically depending on one’s life stage and specific needs. Understanding these nuances is crucial for making an informed decision that aligns with personal priorities.

The decision of whether term or whole life insurance is more suitable depends largely on your current life stage and financial situation. Both types of insurance serve distinct purposes and offer different benefits. While term life insurance is generally more affordable, providing coverage for a specific period, whole life insurance offers lifelong coverage and a cash value component. This section will examine how these factors influence the selection process.

Term Life Insurance: Ideal Scenarios

Term life insurance is a cost-effective solution for individuals who need coverage for a specific period, typically aligning with major financial obligations. This is particularly relevant during periods of high financial responsibility, such as raising a family or paying off a mortgage. For example, a young couple with a new mortgage and young children might opt for a 20-year term life insurance policy to ensure financial security for their family should one parent pass away during that critical period. Once the mortgage is paid off and the children are older, the need for such extensive coverage may diminish. Another example would be a business owner using term life insurance to cover a business loan or partnership agreement for a specific period, aligning with the loan’s duration. This provides a safety net for business continuity in the event of the owner’s death.

Whole Life Insurance: Ideal Scenarios

Whole life insurance, while more expensive, offers lifelong coverage and a cash value component that grows over time. This makes it attractive for individuals seeking long-term financial security and wealth accumulation. For instance, someone nearing retirement with significant assets and a desire to leave a substantial legacy might choose whole life insurance to guarantee a death benefit for their heirs, regardless of when they pass away. The cash value component can also provide a source of funds for future needs, potentially serving as a supplemental retirement income or a means to cover unexpected expenses. An individual with a high net worth and a strong desire for financial stability throughout their lifetime would also find whole life insurance a suitable choice. The predictable, consistent premiums offer peace of mind, and the cash value component provides additional financial flexibility.

Factors Influencing Policy Choice

Several key factors must be considered when deciding between term and whole life insurance. These include the length of coverage needed, the affordability of premiums, the desired death benefit, and the need for cash value accumulation. The individual’s risk tolerance also plays a significant role. Those with a higher risk tolerance might be more comfortable with the potentially higher premiums of whole life insurance in exchange for the long-term benefits and cash value growth. Conversely, those with a lower risk tolerance might prefer the lower premiums of term life insurance, even if it means less comprehensive coverage. A comprehensive financial plan considering current income, expenses, assets, and liabilities is crucial to determine the most appropriate insurance strategy.

Financial Goals and Risk Tolerance

Financial goals significantly influence the choice between term and whole life insurance. Individuals prioritizing affordability and coverage for a specific period, such as paying off a mortgage, would typically opt for term life insurance. The lower premiums allow for greater financial flexibility in other areas. In contrast, individuals with long-term financial security and wealth accumulation goals, and a higher risk tolerance, might prefer whole life insurance. The cash value component offers a potential investment opportunity, while the lifelong coverage provides peace of mind. The level of risk tolerance also plays a vital role. Someone with a lower risk tolerance might prefer the predictability of term life insurance premiums, while someone with a higher risk tolerance might be comfortable with the potential for higher premiums and the possibility of cash value growth in whole life insurance.

Illustrative Examples

Understanding the nuances of term and whole life insurance requires examining real-world applications. The optimal choice depends heavily on individual circumstances, financial goals, and risk tolerance. The following case studies illustrate how these factors influence the decision-making process.

Young Family with Term vs. Whole Life Insurance

A young couple, Sarah and John, aged 30 and 32, have a one-year-old child and are planning for their family’s future. They have a modest income and are focused on paying off their mortgage and saving for their child’s education. Choosing between term and whole life insurance presents a distinct financial challenge.

If Sarah and John opt for a 20-year term life insurance policy with a $500,000 death benefit, their monthly premiums might be around $50. This provides substantial coverage during their prime earning years, protecting their family if either parent passes away unexpectedly. However, the policy expires after 20 years, requiring renewal or purchase of a new policy at potentially higher premiums, reflecting increased age and risk. The lack of cash value accumulation means there’s no investment component.

Alternatively, a whole life policy with a similar death benefit might cost $200-$300 per month. While providing lifelong coverage, this significantly increases their monthly expenses. The higher premium reflects the cash value component, which grows tax-deferred over time. However, the initial investment is substantial, potentially diverting funds from other crucial financial goals like mortgage payments or college savings.

The benefits of term life insurance for Sarah and John are the affordability and high coverage for their family during their most financially vulnerable period. The drawback is the policy’s expiration and the need for future planning. Whole life insurance offers lifelong coverage and cash value accumulation, but the high premiums could strain their budget and limit their ability to achieve other financial objectives.

Retiree with Term vs. Whole Life Insurance

Consider Robert, a 65-year-old retiree living on a fixed income. He’s concerned about leaving a legacy for his grandchildren and wants life insurance to cover potential estate taxes or funeral expenses.

Purchasing a term life insurance policy at this age would be extremely expensive, if available at all, due to Robert’s age and health status. The premiums would likely be prohibitively high, offering limited coverage for a relatively short period.

A whole life insurance policy, purchased earlier in his life, could now offer a significant death benefit and a built-up cash value. This cash value could provide a source of funds for his retirement needs, potentially supplementing his pension or social security benefits. He could access the cash value through loans or withdrawals, though this would reduce the death benefit.

For Robert, a whole life policy purchased earlier in life provides significant benefits in retirement. The established cash value offers financial flexibility, and the death benefit ensures his legacy. The drawback of purchasing a term policy at his age is the high cost and limited coverage. However, if he hadn’t purchased a whole life policy earlier, his options are severely limited in his retirement years.