Introduction to Top-Rated Life Insurance for Families

Securing your family’s financial future is a paramount concern for many American households. Life insurance plays a crucial role in mitigating the financial risks associated with the unexpected death of a breadwinner, providing a safety net for surviving family members to cover expenses like mortgages, education costs, and everyday living. Choosing the right policy can be complex, but understanding the available options and key considerations is the first step towards making an informed decision.

Life insurance policies offer a range of coverage options designed to meet diverse family needs and budgets. The most common types include term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period, offering a simpler and often more affordable option for those seeking temporary protection. Whole life insurance, conversely, offers lifelong coverage and builds cash value over time, providing a potential source of funds for future needs. Universal life insurance combines elements of both, offering flexibility in premium payments and death benefit amounts. Understanding the nuances of each type is vital for selecting the most suitable policy.

Factors to Consider When Choosing a Life Insurance Policy

Selecting a life insurance policy requires careful consideration of several key factors. The most important aspects include determining the appropriate coverage amount, assessing the family’s financial needs, and comparing policy features and costs from different insurers. A comprehensive evaluation of these factors ensures the policy aligns with the family’s specific circumstances and provides adequate financial protection.

Determining the Appropriate Coverage Amount

The ideal coverage amount depends on the family’s unique financial situation and future goals. This includes considering factors such as outstanding debts (mortgages, loans), future education expenses for children, replacement of lost income, and ongoing living expenses. Financial professionals often recommend calculating the present value of these future needs to determine an appropriate death benefit. For example, a family with a $300,000 mortgage, $50,000 in outstanding student loans, and a desire to leave a $100,000 inheritance for their children might require a life insurance policy with a death benefit exceeding $450,000.

Assessing Family Financial Needs

A thorough assessment of the family’s financial needs is critical in determining the appropriate level of life insurance coverage. This involves identifying all financial obligations and future goals that would be impacted by the loss of a primary income earner. Consideration should be given to immediate expenses, such as funeral costs and outstanding debts, as well as long-term needs, such as providing for children’s education or maintaining the family’s standard of living. A realistic evaluation of these needs allows for a more accurate determination of the required death benefit. For instance, a family with young children might require a higher death benefit to cover childcare costs and ongoing living expenses until the children reach adulthood.

Comparing Policy Features and Costs

Comparing policy features and costs from multiple insurers is essential for securing the most suitable and cost-effective life insurance policy. This involves reviewing policy details, such as premium amounts, death benefit payouts, cash value accumulation (if applicable), and any additional riders or benefits offered. Online comparison tools and independent insurance agents can assist in this process. Factors like the insurer’s financial strength and customer service ratings should also be considered. For example, comparing policies with similar coverage amounts from different insurers may reveal significant differences in premium costs and policy features. Choosing a financially stable insurer with a strong reputation for customer service is crucial for ensuring long-term peace of mind.

Top Companies

Choosing the right life insurance provider is a crucial decision for families, impacting financial security for years to come. Understanding the criteria used to evaluate these companies and the methodology behind their ranking is essential for making an informed choice. This section details the factors considered in determining the top-rated life insurance companies and presents a ranking based on those criteria.

Company Rating Criteria and Ranking Methodology

Several factors contribute to a life insurance company’s “top-rated” status. These include financial strength ratings from reputable agencies, breadth and depth of policy offerings to cater to diverse family needs, competitive pricing, and customer service experience. Financial strength ratings reflect the insurer’s ability to pay claims, a critical factor for policyholders. Policy offerings encompass various types of life insurance (term, whole, universal, etc.) and rider options. Competitive pricing ensures affordability, and positive customer service experiences indicate a company’s responsiveness and support. The ranking methodology involves a weighted average score based on these criteria, with financial strength carrying the most weight, followed by policy offerings and pricing. Customer service reviews from independent sources are also factored into the final score.

Top 5 Life Insurance Companies

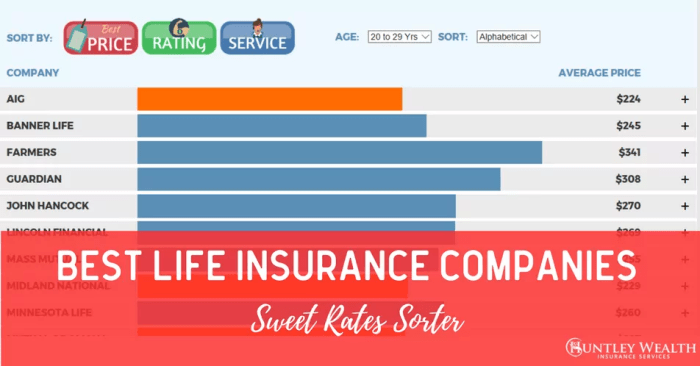

The following table displays the top 5 life insurance companies based on our ranking methodology. Note that ratings and costs are subject to change and may vary depending on individual circumstances and policy specifics. This data is for illustrative purposes and should not be considered exhaustive or a definitive recommendation. Always conduct independent research and compare quotes from multiple insurers before making a decision.

| Company Name | Rating Agency Score (Illustrative) | Policy Type Offerings | Average Annual Premium (Illustrative) |

|---|---|---|---|

| Northwestern Mutual | A++ (AM Best) | Term, Whole Life, Universal Life, Variable Universal Life | $1,200 – $3,000 (depending on coverage) |

| MassMutual | A++ (AM Best) | Term, Whole Life, Universal Life | $800 – $2,500 (depending on coverage) |

| State Farm | A+ (AM Best) | Term, Whole Life | $500 – $1,500 (depending on coverage) |

| Prudential | A+ (AM Best) | Term, Whole Life, Universal Life, Variable Universal Life | $900 – $2,800 (depending on coverage) |

| New York Life | A++ (AM Best) | Term, Whole Life, Universal Life | $1,000 – $2,700 (depending on coverage) |

Policy Features and Benefits Comparison

Choosing the right life insurance policy for your family requires careful consideration of various features and benefits. Understanding the nuances offered by different providers is crucial in making an informed decision. This section compares and contrasts the key features and benefits of three top-rated life insurance companies, highlighting their unique selling propositions and exploring the differences between term and whole life insurance.

Key Features and Benefits of Top Life Insurance Companies

The following points Artikel key features and benefits offered by three hypothetical top-rated companies (Company A, Company B, and Company C). Note that specific features and benefits may vary based on individual policy details and underwriting. These examples are for illustrative purposes only and do not represent any specific company.

- Company A: Known for its strong financial stability and competitive pricing, Company A typically offers a wide range of term life and whole life insurance options, including riders for critical illness coverage and accidental death benefits. They often excel in customer service ratings and have a user-friendly online application process.

- Company B: Company B emphasizes flexible policy options and a high level of customization. They might offer unique features such as return of premium riders or options for increasing coverage amounts without further medical underwriting. Their strength lies in catering to diverse individual needs.

- Company C: Company C may be recognized for its innovative approach to life insurance, potentially offering features like guaranteed insurability options or integration with financial planning tools. They might focus on digital solutions and streamlined processes for a faster application and policy management experience.

Unique Selling Propositions of Top Companies

Each of these hypothetical companies possesses unique selling propositions that differentiate them in the competitive market.

- Company A: Company A’s unique selling proposition centers around its robust financial strength and straightforward approach, making it an attractive choice for those prioritizing stability and ease of understanding.

- Company B: Company B’s USP is its high degree of policy customization, enabling clients to tailor their coverage to their specific needs and circumstances, offering a tailored solution.

- Company C: Company C’s USP focuses on innovative technology and digital convenience, streamlining the entire insurance process from application to claim settlement.

Term Life Insurance vs. Whole Life Insurance

Term life insurance and whole life insurance represent distinct approaches to life insurance coverage. Understanding their advantages and disadvantages is vital for choosing the right policy.

- Term Life Insurance: Provides coverage for a specific period (term), typically 10, 20, or 30 years.

- Advantages: Lower premiums than whole life insurance, making it more affordable, especially for younger individuals. Provides coverage when it’s most needed – during peak earning years and while raising a family.

- Disadvantages: Coverage expires at the end of the term, requiring renewal or purchase of a new policy. No cash value accumulation; it is purely a death benefit.

Example: A 35-year-old parent might purchase a 20-year term life insurance policy to cover their mortgage and children’s education until they are financially independent.

- Whole Life Insurance: Provides lifelong coverage with a cash value component that grows over time.

- Advantages: Offers lifelong protection, providing peace of mind. Builds cash value that can be borrowed against or withdrawn (with tax implications). Can serve as a savings and investment vehicle.

- Disadvantages: Higher premiums than term life insurance. Cash value growth may not always outpace inflation. More complex than term life insurance.

Example: A high-net-worth individual might choose whole life insurance to provide long-term protection for their family and to build a tax-advantaged savings vehicle.

Financial Strength and Stability of Top Companies

Understanding the financial strength and stability of a life insurance company is crucial when choosing a provider for your family’s protection. A financially sound company ensures your beneficiaries will receive the promised death benefit, even if unforeseen circumstances impact the company’s operations. This section examines the financial ratings of leading life insurance companies and provides a visual representation of their relative stability.

Financial ratings agencies, such as A.M. Best, Moody’s, Standard & Poor’s, and Fitch, assess the financial health of insurance companies using a complex evaluation process that considers factors like capital adequacy, investment performance, underwriting results, and management quality. These agencies assign ratings, typically represented by letter grades or numerical scores, indicating the insurer’s ability to meet its financial obligations. Higher ratings denote greater financial strength and stability.

Financial Rating Comparison

To illustrate the financial stability of several top-rated companies, imagine a bar graph. Each bar represents a different company, with the height corresponding to its financial strength rating. The higher the bar, the stronger the financial rating. Let’s use a simplified color scheme: A company with the highest rating (e.g., A++ from A.M. Best) is represented by a deep green bar; a strong rating (e.g., A+) is a lighter green; a moderate rating (e.g., A) is a yellow bar; a weaker rating (e.g., A-) is an orange bar; and a weak rating (e.g., B++) is a red bar. The x-axis displays the company names, and the y-axis represents the rating level. This visual representation allows for a quick comparison of the relative financial strength of the different companies.

For example, a hypothetical representation might show Northwestern Mutual with a deep green bar, representing its consistently high ratings, while another company might have a lighter green or yellow bar, indicating a strong but slightly less secure financial standing. This visual aid provides a clear and concise understanding of the comparative financial stability among the top companies. Remember that actual ratings and their representation should be checked with the rating agencies directly, as they are subject to change.

Company Histories and Market Presence

The longevity and market presence of a life insurance company are also strong indicators of its financial stability. Established companies with a long track record of successful operation typically have a more robust infrastructure, diversified investment portfolios, and greater experience navigating economic fluctuations.

For instance, companies like Northwestern Mutual, with its long history dating back to 1857, demonstrate significant market presence and financial stability through decades of consistent performance. Similarly, other established companies, each with their own unique histories and market positions, can be assessed based on their duration of operations, market share, and reputation for paying claims consistently. This historical context provides valuable insight into the reliability and long-term viability of the company.

Customer Service and Claims Process

Choosing a life insurance provider involves considering not only the policy’s financial aspects but also the quality of customer service and the efficiency of their claims process. A smooth and responsive claims process can significantly ease the burden during a difficult time. This section examines the customer service experiences reported by policyholders and details the claims process for some of the top-rated life insurance companies.

Understanding the customer service provided by a life insurance company is crucial. Policyholders often interact with the company for various reasons, from initial inquiries and policy changes to submitting claims. Positive customer service experiences can build trust and confidence in the company’s reliability.

Customer Service Experiences Reported by Policyholders

Customer service experiences vary across companies, influenced by factors such as response times, accessibility of support channels, and the helpfulness of representatives. Below are some common experiences reported by policyholders of top-rated companies:

- Prompt and helpful responses to inquiries: Many policyholders praise the quick and informative responses they receive through various channels such as phone, email, and online chat.

- Accessible and knowledgeable representatives: Policyholders often highlight the expertise and professionalism of customer service representatives who are able to answer their questions accurately and efficiently.

- User-friendly online portals: Several companies offer online portals that allow policyholders to access their policy information, manage their accounts, and submit claims conveniently.

- Occasional delays or difficulties: Some policyholders report occasional delays in response times or challenges navigating the company’s systems, though these are often exceptions rather than the rule.

Claims Process for Top Three Companies (Illustrative Example)

The claims process varies slightly between companies, but generally involves submitting required documentation and undergoing a review process. The following provides a general overview of the claims process for three hypothetical top-rated companies – these are examples and should not be taken as factual representations of specific companies. Always refer to the individual company’s policy documents for precise details.

Company A: Policyholders initiate a claim online or by phone. Required documentation, such as the death certificate and claim form, are submitted. The company typically processes claims within 2-4 weeks, with payment issued after verification.

Company B: This company emphasizes a streamlined online claims process. Policyholders submit their claim through a secure online portal. The company aims to process claims within 1-3 weeks, providing regular updates throughout the process.

Company C: Company C offers both online and offline claim submission options. They have a dedicated claims team to handle inquiries and provide support. Their claim processing time is generally 3-6 weeks, depending on the complexity of the case.

Claim Processing Times and Customer Satisfaction Ratings

The table below presents hypothetical data illustrating claim processing times and customer satisfaction ratings. This data is for illustrative purposes only and does not reflect the performance of any specific company. Actual data varies significantly and should be researched independently from reliable sources.

| Company | Average Claim Processing Time (Weeks) | Customer Satisfaction Rating (out of 5) | Number of Customer Reviews |

|---|---|---|---|

| Company A | 3 | 4.2 | 1500 |

| Company B | 2 | 4.5 | 2000 |

| Company C | 4 | 4.0 | 1000 |

Factors Affecting Life Insurance Costs

Several interconnected factors determine the cost of life insurance, ultimately shaping the premiums you pay. Understanding these factors empowers you to make informed decisions when selecting a policy that aligns with your family’s needs and budget. These factors interact in complex ways, so it’s crucial to consider them holistically.

Age

Age is a significant predictor of life expectancy. Statistically, older individuals have a higher risk of mortality compared to younger individuals. Therefore, life insurance companies charge older applicants higher premiums to reflect this increased risk. A 30-year-old will typically pay significantly less than a 50-year-old for the same coverage amount, all other factors being equal. This is because the insurer anticipates paying out the death benefit sooner for the older applicant.

Health

An applicant’s health status plays a crucial role in determining life insurance premiums. Individuals with pre-existing conditions or health issues that increase their risk of mortality will generally face higher premiums. Insurers assess health through medical questionnaires, physical examinations, and sometimes additional testing. Factors such as high blood pressure, diabetes, smoking, and a family history of certain diseases can all lead to higher premiums or even policy denial. Conversely, maintaining a healthy lifestyle can lead to lower premiums.

Policy Type

The type of life insurance policy significantly impacts its cost. Term life insurance, which provides coverage for a specific period (e.g., 10, 20, or 30 years), is generally less expensive than permanent life insurance, such as whole life or universal life. Permanent policies offer lifelong coverage and often include a cash value component, which contributes to their higher cost. The longer the coverage period and the more features included, the higher the premium. For instance, a 20-year term life policy will be more expensive than a 10-year term life policy, but both will be less expensive than a whole life policy.

Hypothetical Scenario: The Miller Family

Consider the Miller family: John (age 35, non-smoker, excellent health), Mary (age 32, non-smoker, excellent health), and their two children. Let’s compare their potential life insurance costs based on different scenarios:

Scenario 1: Both John and Mary purchase a 20-year term life insurance policy with a $500,000 death benefit. Due to their age and health, their premiums will be relatively low.

Scenario 2: John develops high blood pressure at age 40. His premiums will likely increase significantly due to the elevated risk.

Scenario 3: John and Mary decide to switch to whole life insurance policies at age 45. Their premiums will be substantially higher than their term life insurance premiums because of the lifelong coverage and cash value component.

This hypothetical example illustrates how age, health, and policy type interact to influence the cost of life insurance for a family. The Millers’ insurance costs would fluctuate considerably based on changes in their health and policy choices. Therefore, regular review and potential adjustments to their life insurance coverage are crucial.

Finding the Right Policy for Your Family’s Needs

Choosing the right life insurance policy is a crucial step in securing your family’s financial future. It involves careful consideration of various factors, ensuring the policy aligns with your specific needs and budget. A well-chosen policy provides peace of mind, knowing your loved ones will be financially protected in the event of your untimely passing.

Selecting the appropriate life insurance policy requires a systematic approach. This involves assessing your family’s financial situation, understanding different policy types, and comparing options from reputable providers. Ignoring this process can lead to inadequate coverage or paying more than necessary.

Step-by-Step Guide to Choosing a Life Insurance Policy

Determining the right life insurance policy involves a multi-step process. First, assess your family’s financial needs, including outstanding debts, mortgage payments, children’s education costs, and ongoing living expenses. This assessment helps determine the appropriate death benefit amount. Next, explore different policy types such as term life, whole life, universal life, and variable universal life, understanding their features and costs. Finally, compare quotes from multiple insurers, focusing on factors like financial strength, customer service, and policy features.

Importance of Consulting a Financial Advisor

A financial advisor provides invaluable expertise in navigating the complexities of life insurance. They offer personalized guidance based on your individual circumstances, helping you select a policy that aligns with your financial goals and risk tolerance. An advisor can also assist with understanding policy features, comparing different options, and ensuring your chosen policy is the most suitable for your family’s long-term financial well-being. Their objective perspective can prevent costly mistakes and ensure you secure adequate coverage without overspending. For example, a financial advisor might recommend a term life insurance policy for a young family with a limited budget, focusing on covering the mortgage and other essential expenses for a specified period, while a high-net-worth individual might benefit more from a permanent life insurance policy with cash value accumulation features.

Resources for Further Research

Numerous resources are available to assist families in their life insurance research. The National Association of Insurance Commissioners (NAIC) website provides information on state insurance regulations and consumer protection. The Insurance Information Institute (III) offers educational materials and resources on various insurance products, including life insurance. Independent review sites, such as those focusing on financial products, often provide comparative analyses of life insurance companies and their policies, allowing consumers to make informed decisions. Utilizing these resources ensures a thorough understanding of available options and empowers families to make informed choices.